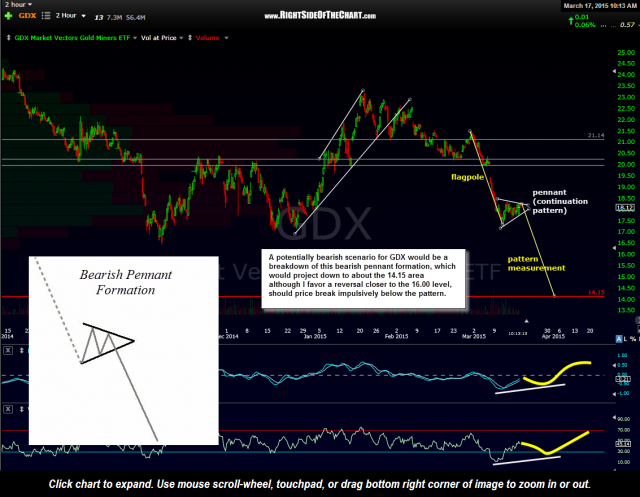

I do my best to avoid posting a lot of contradicting analysis and want to reiterate that my preferred scenario remains to see gold prices reverse trend from at or near current levels, possibly on one final trust lower to put in a marginal new low before mounting a lasting rally. With that being said, I would be remiss not to point out this potentially bearish scenario for GDX; A breakdown of this bearish pennant formation (120 minute chart shown here), which would project down to about the 14.15 area although I favor a reversal closer to the 16.00 level, should prices break impulsively below the pattern.

Again, this is not my preferred scenario although as I’ve discussed quite a bit recently, gold (along with the miners) has been notorious for false breakouts & breakdowns in recent months so to see prices break below this bearish pennant continuation pattern, only to reverse sharply well before prices fall to the measured move of the pattern (length of the flag-pole subtracted from the last tag of the top of the pattern), would not only not surprise me, but I would almost expect it.

Of course, the possibility of an upside break of the pennant is a possibility as well. Remember, some of the most powerful moves come immediately following a false breakdown of a well-watched technical pattern as traders that bought (or sold) the breakout (breakdown) are force to quickly sell (cover) their positions once it has become clear that the signal was a whipsaw. Add to that the fact that the FOMC announcement tomorrow afternoon will almost certainly cause some sharp reactions in either (and likely, both) directions in currencies, gold & equities tomorrow, you can almost count on some choppy price action and most likely some false buy & sell signals (as well as stops run) if those orders are placed to close to current levels.

On a final note, I will be away from my desk most of the day tomorrow, possibly returning shortly before the close. Best to keep things light & be very selective on establishing new positions until after the post-Fed announcement dust settles.