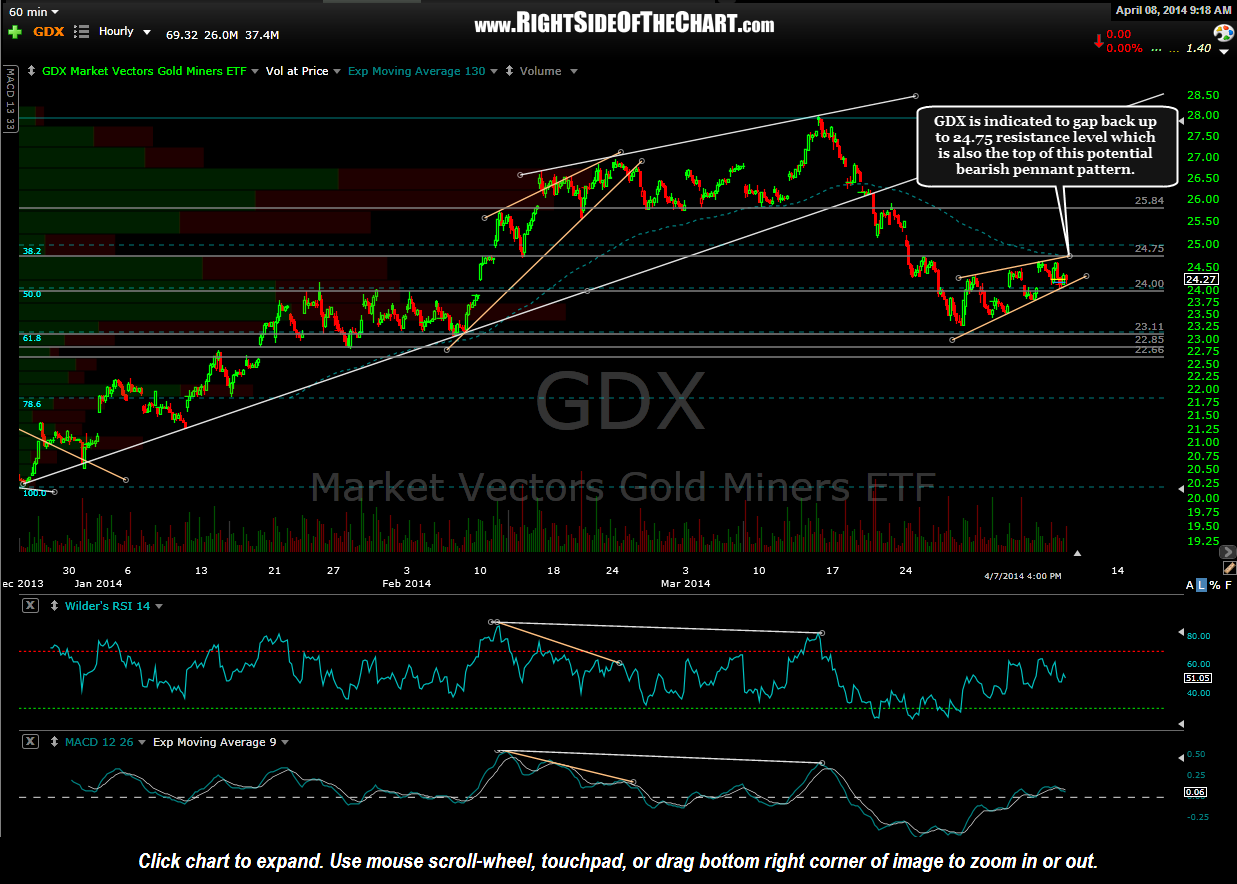

GDX (Market Vectors Gold Miners ETF) is indicated to gap back up to 24.75 resistance level which is also the top of this potential bearish pennant pattern. The 24.75 level is the first near-term target listed on the prior string of 15 minute charts. If GDX can make a solid & sustained break above the 24.75 level, there is a thin zone up to the next near-term target of 25.20ish that is likely to be filled. However, should GDX once again turn down from this resistance level, as with the two recent failed attempts to take it out, that could send prices back down to the bottom of the bearish pennant. Should GDX break down from the pennant, the measure move on the pattern projects to around the 20.50 area. Personally, I plan to reduce exposure to the miners on the opening gap but may add back exposure should GDX make a solid break above the 24.75 level.

Results for {phrase} ({results_count} of {results_count_total})

Displaying {results_count} results of {results_count_total}