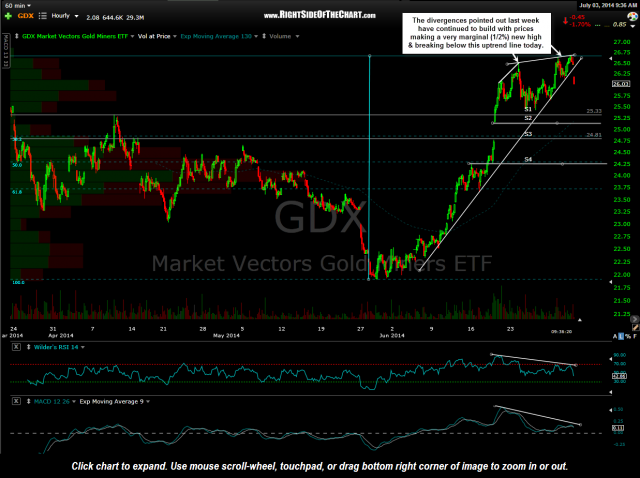

The divergences pointed out last week on GDX (Gold Miners EF) have continued to build with prices making a very marginal (1/2%) new high & breaking below this uptrend line today. With the marginal new high, I had adjusted the Fibonacci retracement levels with still come in virtually right with the S3 & S4 support levels.

Regardless of the continued likelihood of a pullback to one or more of these support levels, the intermediate & longer-term outlook for gold, silver & the associated mining stocks still looks very constructive IMO. As such, I have no desire to take a counter-trend trade (i.e.-short) the miners as I still would not be surprised to see the buyers overwhelm these short-term bearish divergences and today’s uptrend line breakdown. With that being said, I also continue to hold off adding back the exposure to the sector that I recent reduced, awaiting either a pullback to one or more of these downside support targets -or- a solid & impulsive break above the recent trading range in both gold, silver & the mining stocks. Once again, longer-term traders and investors should not be overly concerned with the near-term outlook for the sector other than maybe strategically adding lots on a pre-determined scale in plan.