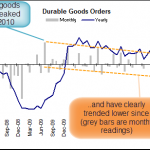

i had a few things come up last night so i’ll try to get a couple of those longer-term index charts out today. speaking of today, i think the action might be somewhat muted in front of the GDP numbers scheduled to be released tomorrow morning. more active traders should keep an eye on the upcoming economic releases available via the “Economic Calendar” link on the right side of the page under “Tools of the Trade”. note that the key that i’ve circled on the bottom of the calendar, which helps identify the potentially market-moving releases. yesterday’s Durable Goods report was the biggest drop in over 3 years but luckily, the market was bailed out as that report (and just about all other global events) was overshadowed by yet another phenomenal blow-out quarter from AAPL.

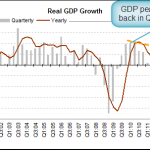

with the AAPL-fest now behind us, all eyes will likely turn to the GDP report tomorrow morning, which could easily turn out of be a non-event or even a positive for the markets, but like Durable Goods Orders, which has been clearly trending lower since july 2009, GDP has also been trending lower since it peaked back in the first quarter of 2010.