Based upon further review of the charts, I have revised the downtrend line on my 60-minute chart of the GBTC Active Long Swing Trade to better align with the comparable downtrend line on /BRR (Bitcoin futures). GBTC is currently poised to gap up around the slightly revised downtrend line, which remains the 2nd & final target. The revised downtrend line comes in around the 11.18+/- area today.

/BRR has gapped above the downtrend line + the key 9522 former support, now resistance level on what may prove to be a momentum-fueled overshoot. A momentum-fueled overshoot is a term that I use when a security in a very strong, near-vertical rally or correction briefly overshoots a resistance or support level which would have (and eventually does) produce a reaction on the initial tag, or in that case, a reaction following the brief momo-fueled overshoot, where the strong momentum briefly carries the security beyond the resistance or support level, followed by a move back under/above it.

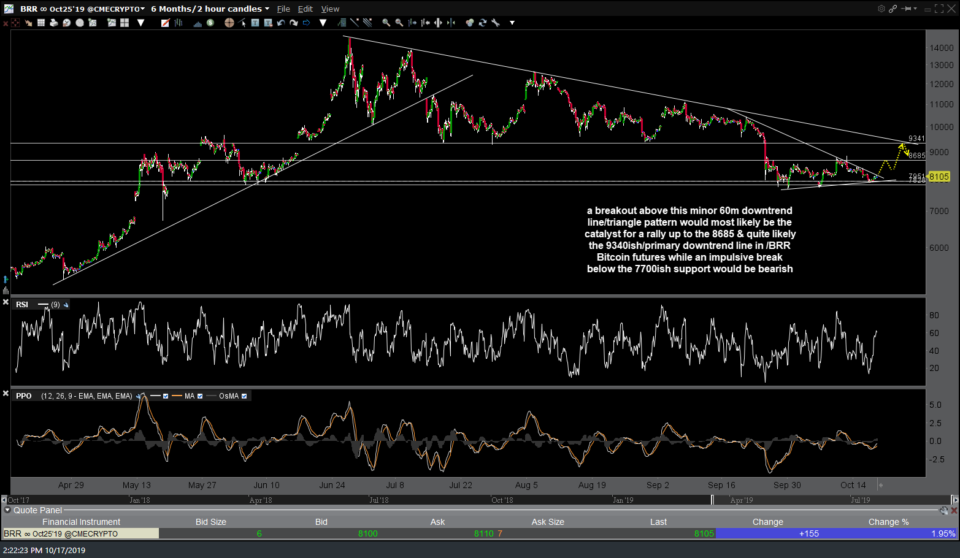

- BRR 120m Oct 17th

- BRR 120-min Oct 28th

The previous (first) 120-minute chart above from Oct 17th shows the expected rally up to the primary downtrend + 9522* resistance level with a reaction there likely. (*that previous chart showed the horizontal price resistance as 9341 instead of 9522 as the continuous futures contract at that time was the Oct contracts vs. the current continuous contract which has since rolled to the December contract, hence the different values at that key support/resistance line).

Those currently long the GBTC swing trade might opt to book profits here in the pre-market session as GBTC is currently trading at 11.20 or around that level in the regular session. One could also opt to raise stops & let the position ride if planning to hold out for additional gains as it is very possible that this breakout above the downtrend line in /BRR sticks with Bitcoin continuing to rally from here. However, the official trade will be closed out if & when GBTC hits the revised downtrend line.