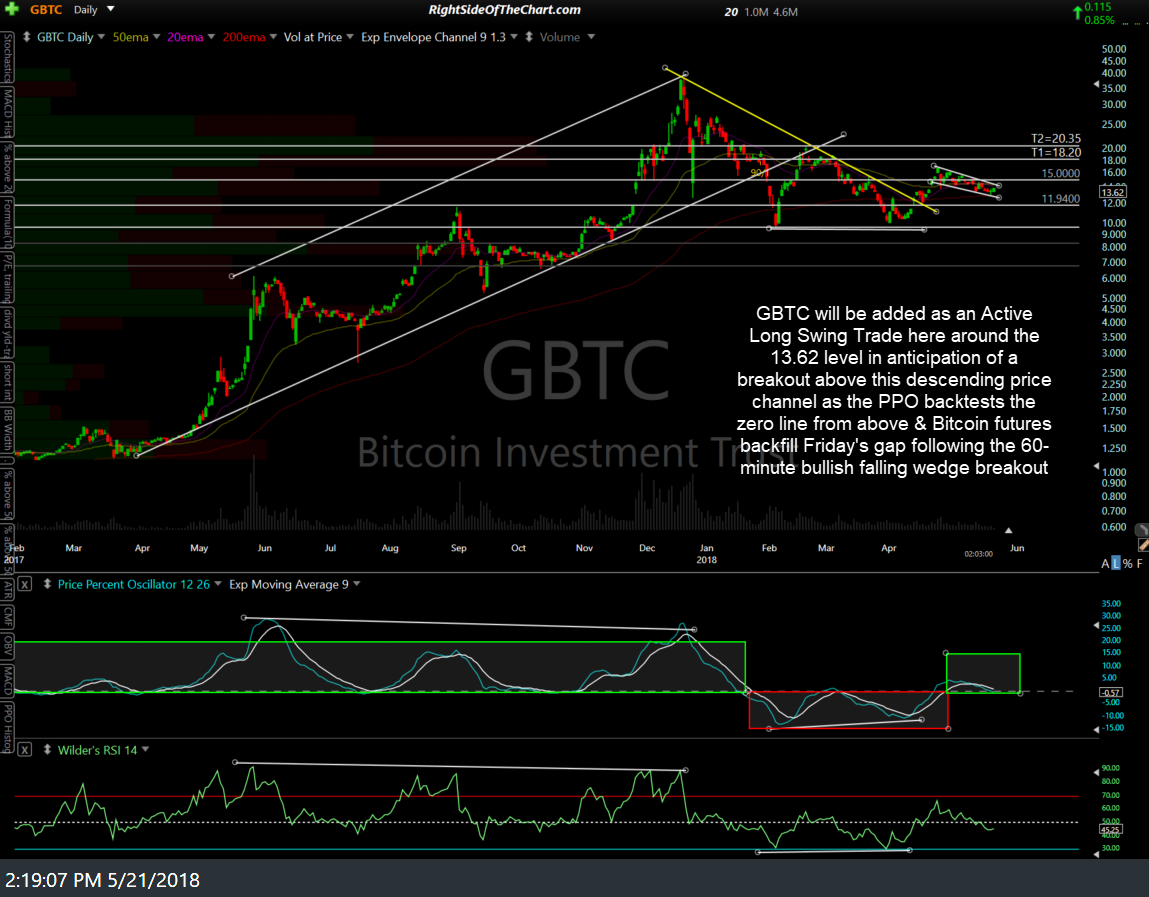

GBTC will be added as an Active Long Swing Trade here around the 13.62 level in anticipation of a breakout above this descending price channel as the PPO backtests the zero line from above & Bitcoin futures backfill Friday’s gap following the 60-minute bullish falling wedge breakout.

- GBTC daily May 21st

- GXBT 60-min May 21st

The price targets for GBTC are T1 at 18.20 & T2 at 20.35. The suggested stop is any move below 11.79. Due to the aggressive nature of both Bitcoin as well as GBTC, which trades on the pink sheets & will trade at a premium or discount to Bitcoin, the suggested beta-adjusted position size for this trade is 0.35-0.50 (i.e.- half of a typical position size or less, depending on your risk tolerance, assuming this type of trade meshes with your trading style & objectives to begin with). Reducing the position size helps to account for the above average gain (~45%) and loss (~15%) if the final target or maximum suggested stop is hit.