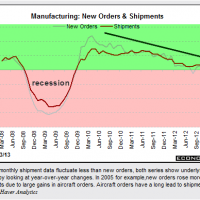

I got off to a late start today and once I booted up and noticed the markets were about to gap up I started to put together the charts and my thoughts on the previous post as I wanted to share my thoughts in advance of the two reports issues at 10:00 was only barely able to get that post off before then. No surprise, both Factory Orders and the ISM Non-Manufacturing Index came in below expectations with both at the low end of the range. None of that seems to matter lately as the market has a very strong bid beneath it but unless the clearly deteriorating trend in the macro-fundamentals begins to reverse soon, the reversion to the mean will almost certain begin to manifest in stock prices sometime in 2013.

As IWM has now moved above the downtrend line off the March 15th highs as well as exceed the two previous reaction highs (and TZA has exceeded it’s suggest stop level) that trade will be considered stopped out. I’ll also work in cleaning up the trade ideas as I had planned to recently but have once again been side-tracked with the recent PC and website issues that I thought were resolved. Today will undoubtedly clear out a lot of short interest and will short interest already at or near record low levels, that creates the potential for a very sudden and swift move lower should any bad news or HFT glitch hit the market. As such, regardless of today’s bullish action and unwinding of a lot of the bearish technicals that were in place, the R/R to establishing new long positions remains unfavorable at this time.