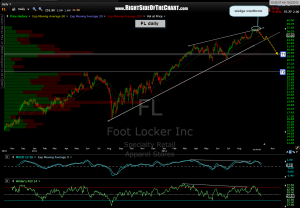

i have made another slight revision to the FL price targets, moving T1 slightly higher to more accurately reflect where i think prices might find the first key support area once/if the bearish rising wedge pattern breaks down. FL is an active short that was originally posted with two entry criteria: 1) at the top of the wedge in anticipation of the wedge breakdown and/or 2) on a break below the bottom of the wedge.

i have made another slight revision to the FL price targets, moving T1 slightly higher to more accurately reflect where i think prices might find the first key support area once/if the bearish rising wedge pattern breaks down. FL is an active short that was originally posted with two entry criteria: 1) at the top of the wedge in anticipation of the wedge breakdown and/or 2) on a break below the bottom of the wedge.

in keeping with my recent preference of more liberal stops, FL tested my patience to just about the limit but has yet to shake me out. the suggested stop in the last post was on a move above the 37.50 area and although prices managed to briefly move into that range on an intraday spike (37.65 spike high or 0.4% above 36.50), FL has yet to close above that area. now that the prices have moved well back into the pattern following the recent overthrow, this trade is looking much better and would provide a second objective short entry (add-on or a new short) on a break below the bottom of the wedge. stops remain on a close or significant move above the 37.50 area.