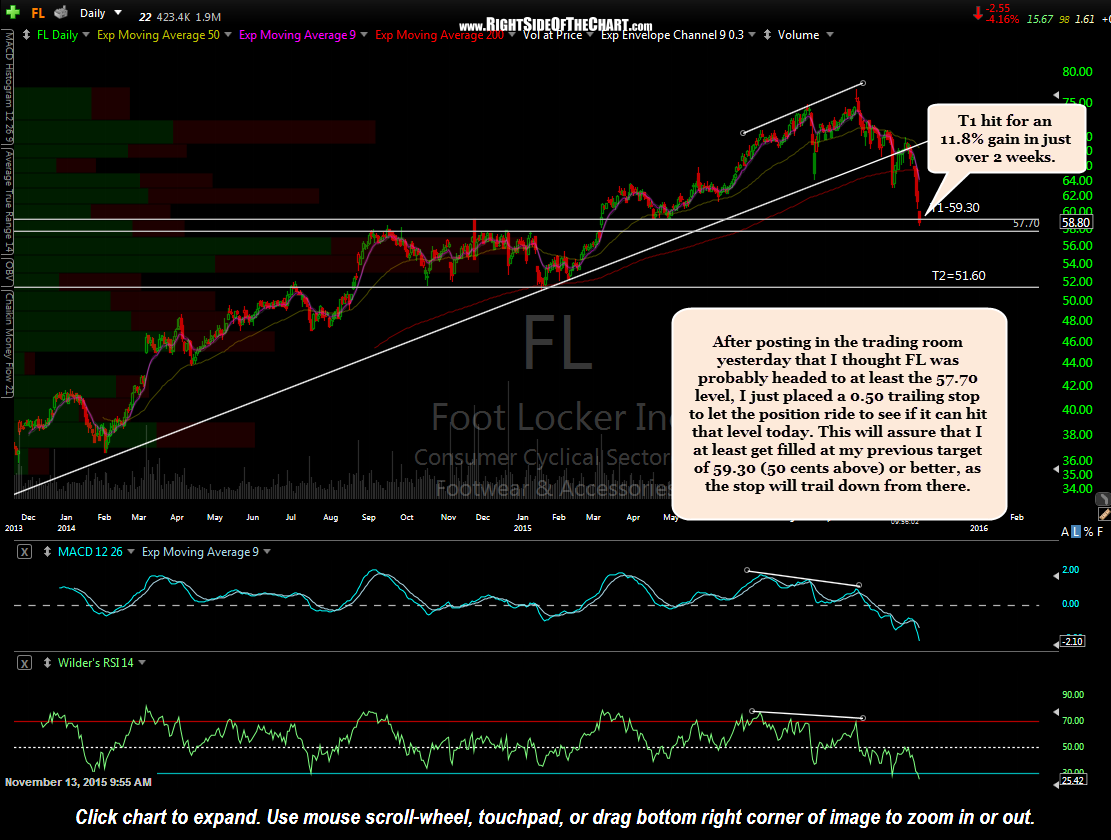

The FL (Foot Locker) Active Short Trade has now hit the first target for a gain of 11.8% in just over 2 weeks from entry. Consider booking partial or full profits and/or lowering stops, depending on your trading plan.

Trading Tip: Yesterday in the Trading Room, I had posted that upon further review of the charts, I believed that FL would likely exceed the first target, likely moving down to at least the 57.70 area and as such, that I was considering lowering price target or trailing stops to allow my profits to run (T2 remains the final target at this time). With the broad markets confirming my bearish analysis today, I just set a trailing stop 50¢ above the current price of 58.80. That will assure that, worst case scenario, I get filled at my original first profit target (T1 at 59.30) if the stock reverses from here while also allowing my profits to build, should the stock continue lower.

The only way that strategy could backfire would be if I decide to let the position ride beyond the close today, thereby risking the possibility of an opening gap that could trigger my trailing stop-loss order above the 59.30 level. As such, I will make a decision before the close to either close the trade at or just above the 57.70 support level or let the FL short continue to ride as a longer-term swing trade down to the T2 level (51.60). However, I just wanted to impress the benefit of using trailing stops and/or lowering your stops to protect profits once an initial profit target is reached if you believe that the trade may continue to run in your favor.