Member @dazi had commented about the FIZZ swing trade within the trading room where I had posted the following response & also wanted to share these additional comments & charts for anyone in the trade:

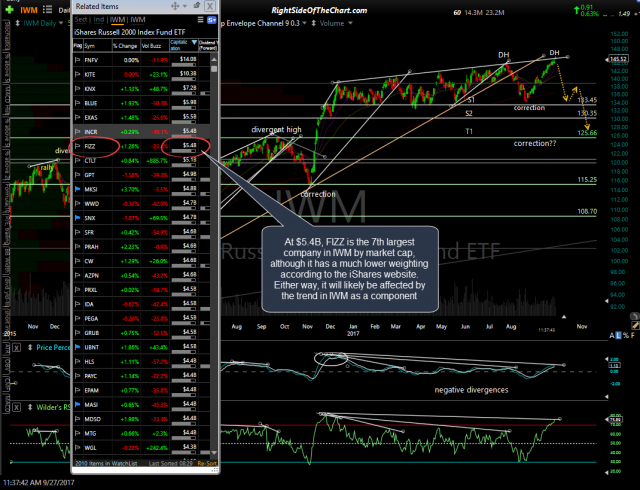

FIZZ is a component of IWM. Surprisingly, it appears it way down the list as far as the weightings go as by market cap (according to the iShares website) although it is the 7th largest company in IWM. As such, FIZZ is most likely getting sympathy buying from IWM on this recent rally but the stock is still trading well below the uptrend line as of now.

Looking at the 60-min chart, FIZZ is testing the 118.81 former support, now resistance level from below with the next R above that around 121. 60-minute trend indicators remain bearish for now but could flip to bullish soon if those R levels are taken out. Therefore, if you aren’t confident about that or any of your other positions, there’s nothing wrong with modified your trading plan & stopping out of FIZZ if it takes out either of those resistance levels, ideally on a 60-min closing basis. I’ll post of few charts of FIZZ & IWM above.

This first chart below is a 2-year daily chart with both IWM & FIZZ, illustrating the relatively tight correlation between the two. As a component of IWM, FIZZ will largely trade inline with the Russell 2000 Small Cap Index. The 2nd chart is a 2-year daily chart of IWM highlighting the most recent divergent high along with my preferred scenario over the coming months.

- FIZZ vs. IWM 2-year daily Sept 27th

- FIZZ daily Sept 26th

Next up are the 60-minute charts of IWM & FIZZ. Potential negative divergences building on IWM just as it had back in late July before the 7% correction. Confirmation of those divergences to come on a bearish crossover on the 60-min PPO with a sell signal on a break below the uptrend line. On FIZZ, chances are this wedge breakdown will result in a move down to at least the T1 level if IWM reverses trend soon. Otherwise, FIZZ may make a run at a backtest of the wedge from below, taking out the suggested stop in the process. As of now, I still favor the former vs. the latter scenario.

- IWM 60-min Sept 27th

- FIZZ 60-min Sept 27th