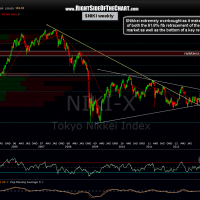

I am modifying the suggested stop on the EWJ short to a weekly close above 11.85 vs.any intraday or daily close above that level. Below are the updated weekly charts of EWJ and the $Nikkei, both of which are overbought levels rarely, if ever seen, followed by the 60 minute chart of EWJ. As I often say, overbought in itself is not a reason to short a security. However, extreme overbought at the first test of a key resistance does provide an objective short entry for at least pullback trade with the appropriate stops above. I know this market seems like it will go up forever and short-side trades have been very tough lately but from a pure risk-to-reward perspective, this trade still looks objective.

Results for {phrase} ({results_count} of {results_count_total})

Displaying {results_count} results of {results_count_total}