After hitting bouncing off my 31ish target, ETCG (Ethereum Trust) has now hit my 22.44 target where a reaction is likely before the next leg down (note: with GBTC still slightly above the 24.13ish target, ETCG could make a slight momo-fueled overshoot of the 22.44 support/target). Previous daily charts, starting with the May 19th sell signal/breakdown followed by the June 11th tag of the 31ish target & today’s updated daily charts below.

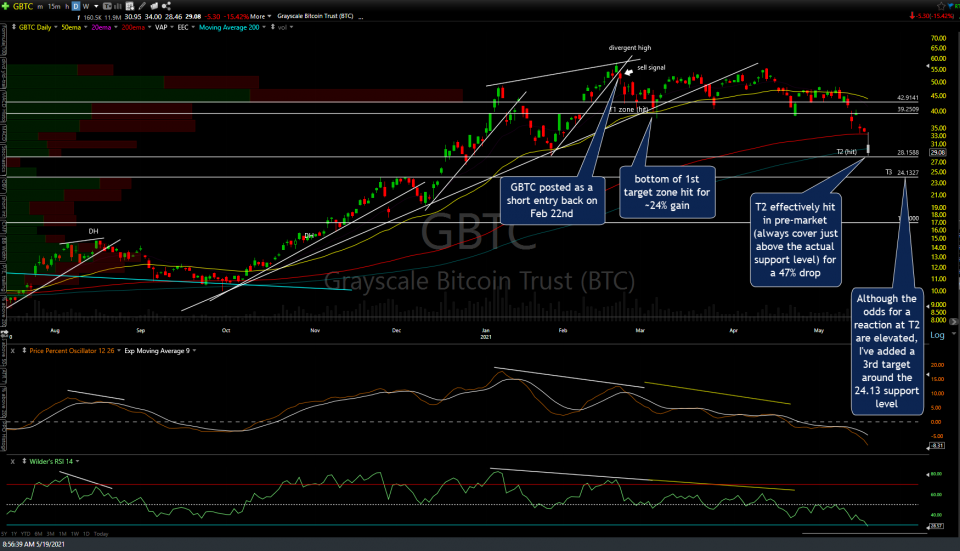

Likewise, GBTC (Bitcoin Trust) is coming up on T3 (24.13ish) where a reaction is likely & potential divergences forming between price & the momentum indicators. Previous & update charts below, starting with the sell signal posted back in Feb 22nd, right off the all-time highs in Bitcoin, followed by the May 19th update & today’s daily chart.

Bottom line: The odds for a reaction (bounce and/or consolidation) on or around the initial tag of these price targets are favorable, therefore ETCG & GBTC provide objective long entries here with stops somewhat below those support levels. At this time, I am only looking for a tradable bounce followed by another leg down although with potential (but unconfirmed) positive divergence forming on GBTC as it approaches T3, a case can be made for a more lasting bottom although it’s still too early to make that case with a high degree of certainly.