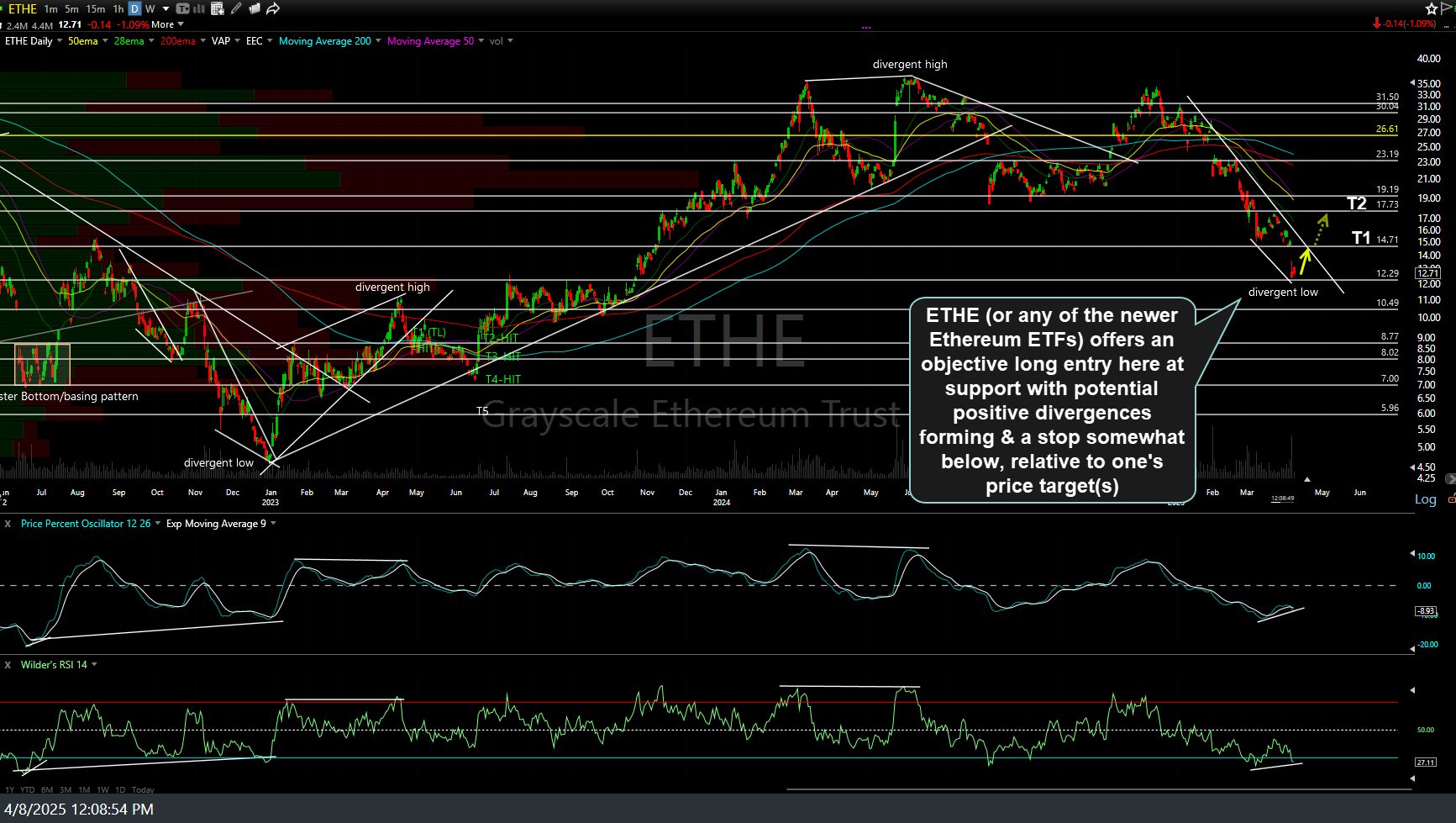

Although I decided to close out the ETHE (ethereum ETF) long swing trade at T1 the other day, it has just hit the potential T3*** (resistance) from the recent long trade, offering an objective but aggressive short entry for a quick pullback trade.

***17.73 was T2 when the long trade was first posted back on May 5th with a new 2nd potential target added at 16 afterwards, with 17.73 remaining the final target but re-sequenced to T3. Previous (initial entry from April 8th & Monday’s) followed by the updated daily chart below.

/ETHUSDRR (ethereum futures) has just hit my 3rd & preferred target** (via solid arrows), rallying 40% from the April 8th long entry, where a tradable reaction is likely before the next leg up to the final potential target. Previous (April 8th) & updated 120-minute charts below.

** the previous 120m chart I posted on the April 8th long entry was the April contract. The horizontal lines (price targets) in this May (current) contract have been placed at the same levels, although prices change slightly when futures contracts roll to the next month.

Just as with the long entry back when Ethereum was in an unmistakable downtrend during one of its most powerful bear markets in history (down about 70% from the highs) with zero evidence of a trend reversal, a short pullback trade here should also be considered an aggressive, counter-trend trade.

Should /ETHUSDRR continue to rally up to my final target zone from April 8th (now about 2350-2480 on the May contract) and/or the downtrend line that comes in just below, that would also offer an objective short entry or add-on to a starter position taken here.