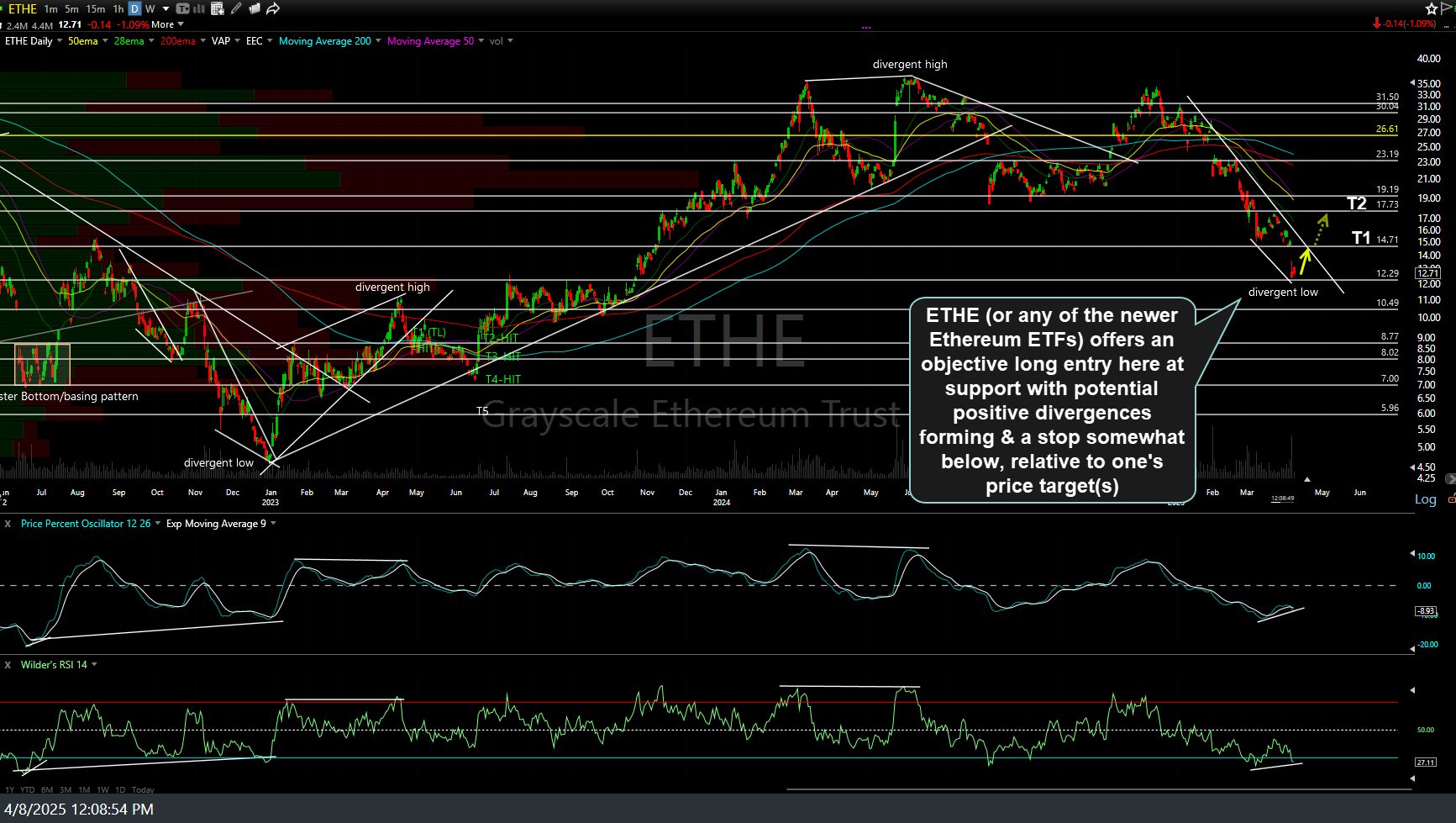

ETHE (Grayscale Ethereum Trust or any of the newer Ethereum ETFs) offers an objective long entry here at support with potential positive divergences forming & a stop somewhat below, relative to one’s price target(s). Daily chart below.

Alternatively, /ETHUSDRR (ethereum futures) offers an objective long entry here with stops commensurate with one’s price target(s). 120-minute chart below.

I also like Bitcoin (/BRR, IBIT, etc..) with the IBIT short swing trade still trading on T3 (3rd price target & support) with positive divergences and additional support not too far below.

ETHE was the first-to-market “ETF-like” vehicle for trading Ethereum in a regular brokerage account although there are now numerous Ethereum-tracking ETFs available. I chose ETHE since the chart history goes back much further & therefore, shows the support level it has current fallen to whereas the newer Ethereum ETFs don’t have much price history in which to apply technical analysis.