My apologies as I had meant to post this yesterday. The ERI short trade is scheduled to report earnings after market close today. I had intended to post an heads-up for ERI’s earnings reports primarily for two reasons; Some traders prefer to close a position before a quarterly earnings report in order to avoid getting caught on the wrong side of an earnings-induced gap while others, like myself, will hold a position as a long as the charts remain clearly bullish or bearish as it has been my experience that more often than not, earnings induced gaps play out in the direction indicated by the charts, again, only for clearly bullish or bearish chart patterns.

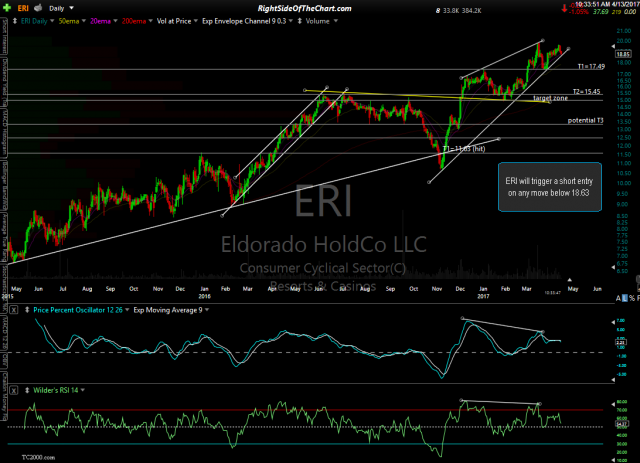

- ERI daily April 13th

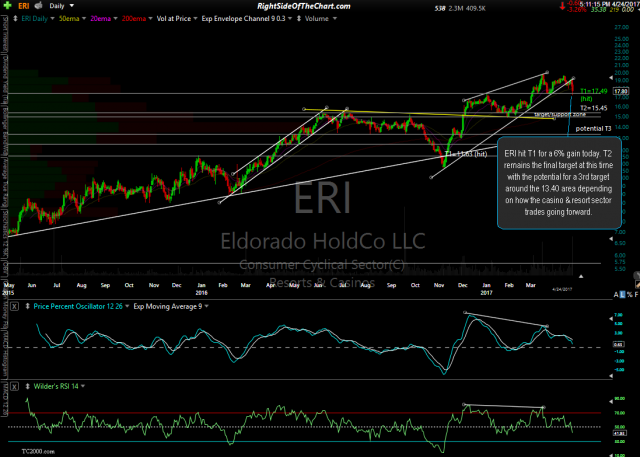

- ERI daily April 24th

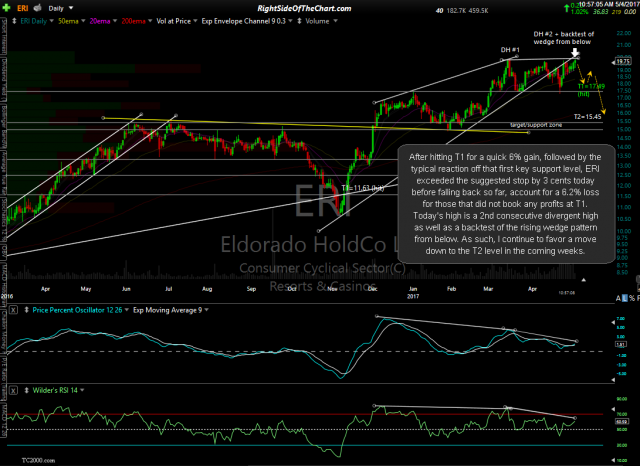

- ERI daily May 4th

My apologies for not getting this post out sooner as member @jameske just pointed out in the trading room that ERI just printed a high of 19.80 vs. a suggested stop above 19.76 (i.e.- any print of 19.77). As such, since I did not revise or suspend the suggested stop on this trade in advance of the stop being hit, ERI will be removed from the Active Trade category & moved to the Completed Trades, both as a successful trade, with T1 already hit for a quick 6% profit shortly after the entry as well as a stopped out trade for a 6.2% loss for anyone holding out for T2 that did not book partial or full profits at T1.

For anyone still short ERI that would like updates posted going forward, just let me know in the comment section below this post & I will continue to do so. Typically, I will typically suspend or widen my stops on any trades that still look promising yet are trading relatively close to their stops just before an earnings report, which is the case with ERI. Again, my apologies for not mentioning that sooner although one could always re-enter a short position tomorrow after earnings are out of the way, assuming that the bearish case is still intact & the stock is offering an objective entry at the time.