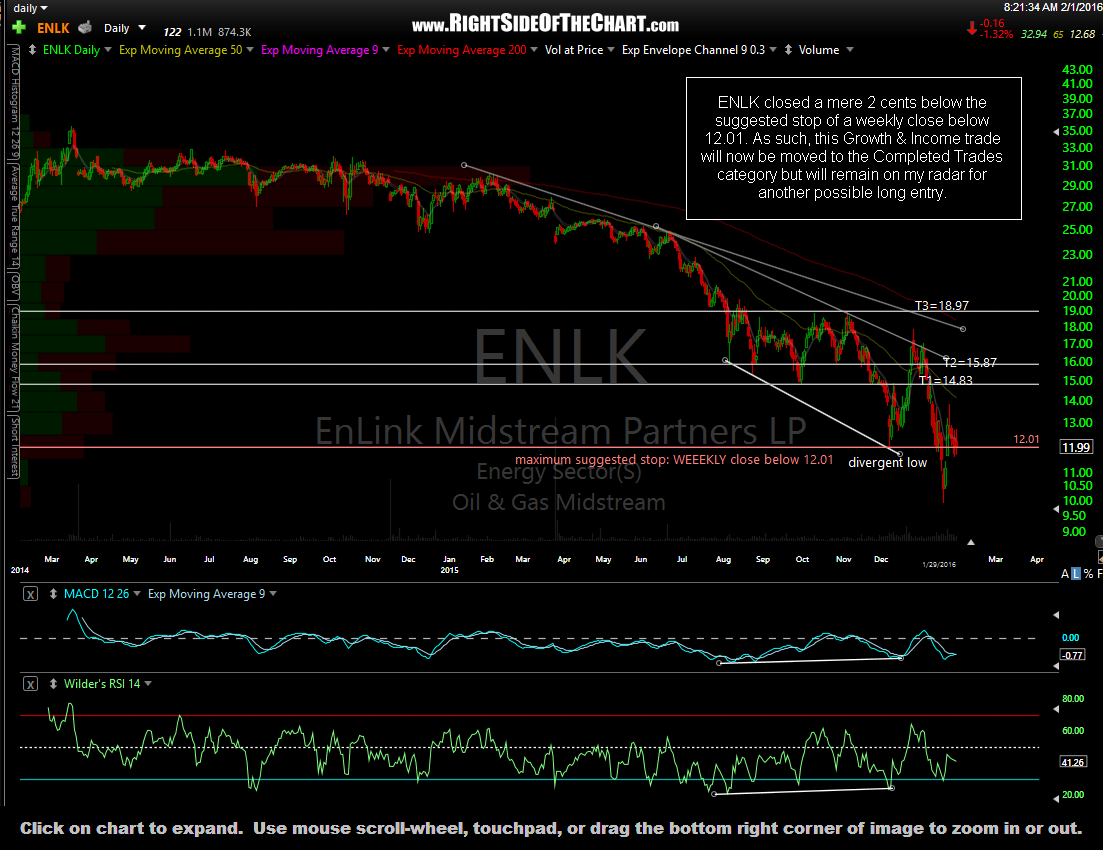

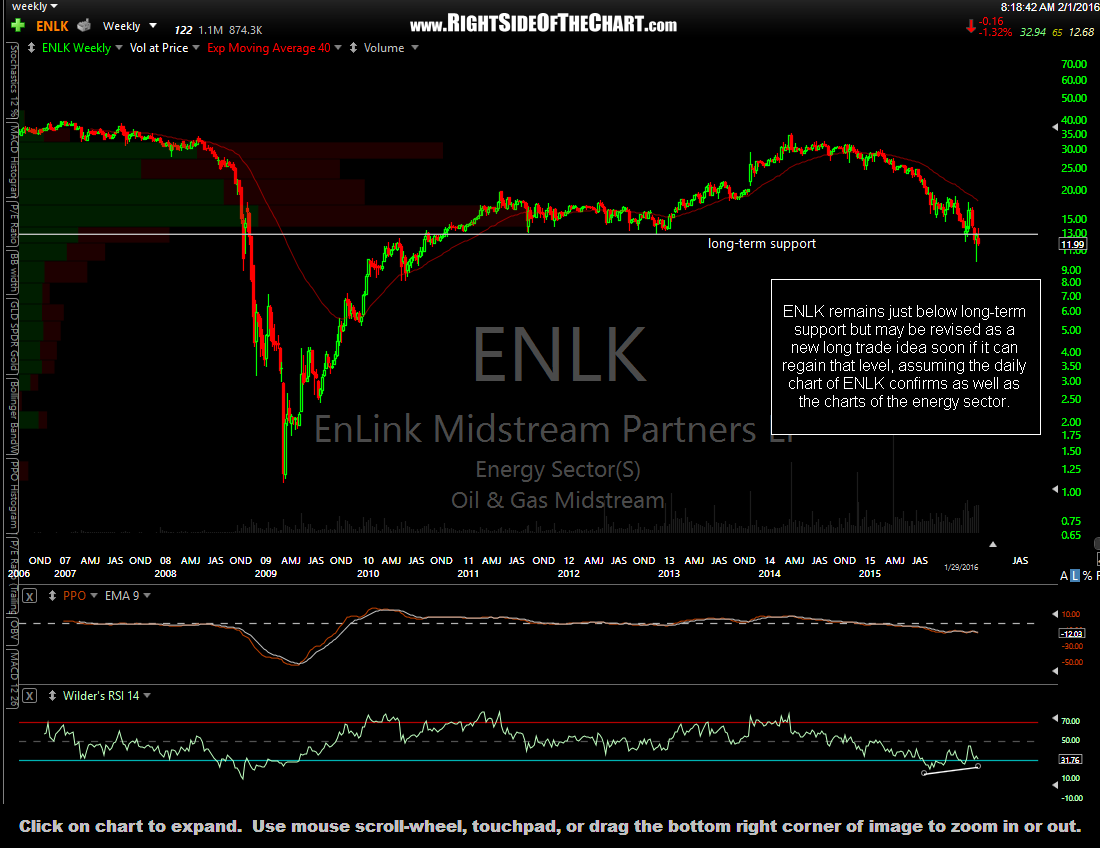

ENLK (EnLink Midstream Partners LP) closed a mere 2 cents below the suggested stop of a weekly close below 12.01, providing a 6.7% loss* on the trade for those that were holding out for T3 on all shares. As such, this Growth & Income trade will now be moved to the Completed Trades category but will remain on my radar for another possible long entry. The loss was calculated using the adjusted cost basis for this trade.

*ENLK had hit both T1 & T2 very shortly after the December 15th entry for a 20% profit in just 5 trading sessions before reversing at the minor downtrend line on the daily chart. The entry on ENLK was on Dec 15th at 13.24. The stock went ex-dividend last week, meaning that anyone long the stock last week, even if they closed out the trade at Friday’s close, will receive a dividend of 39¢ per share, thereby reducing the cost basis on the trade from 13.24 to 12.85. I would also state that for those who decided to give the trade a little more room, I still think there is a decent chance that the final target of 18.97 will be hit over time.