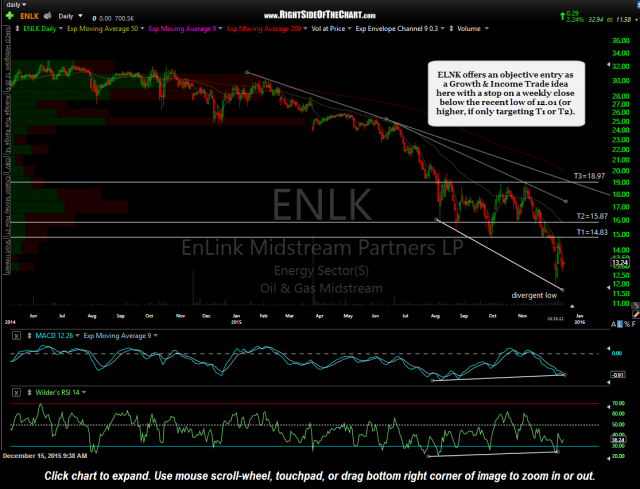

ELNK (EnLink Midstream Partners LP) offers an objective entry here with a stop on a weekly close below the recent low of 12.01 (or higher, if only targeting T1 or T2) & a final price target of 18.97. ENLK is a growth & income (dividend) trade idea currently yielding 11.58%. Following the recent divergent low, the stock kissed the 14.85 resistance level last week on a sharp rally that was induced by an CNBC interview with the CEO.

- ENLK daily Dec 15th

- ENLK weekly Dec 15th

From a fundamental perspective, in this recent interview, the CEO stated that the dividend is secure & that “…that 95% of EnLink’s gross margins stem from fees and not the price of the commodities (oil) that flow through its system.” Sounds like ENLK is a case of the “baby got thrown out with the bath water” as it has been caught up in the broad based selling of anything related to the energy industry.

Growth & Income Active Trades are longer-term swing trade or investment candidates expected to generate an above average dividend yield and capital appreciation. Ideally, traders & investors should look to add to or initial a new position objectively, such as a pullback to support. Similar to the Long-Term Trade Ideas, the expected holding period for the Growth & Income Trade Ideas ranges from at least several months to a year or more.