ENDP (Endo International PLC) will be added here as an Active Swing Trade + Long-term Trade idea following this divergent low. The stock is rallying today following their earnings report & forward guidance & very well may have put in a lasting bottom to the 2½ year bear market that has erased nearly 94% of this pharmaceutical company’s value.

- ENDP daily Nov 10th

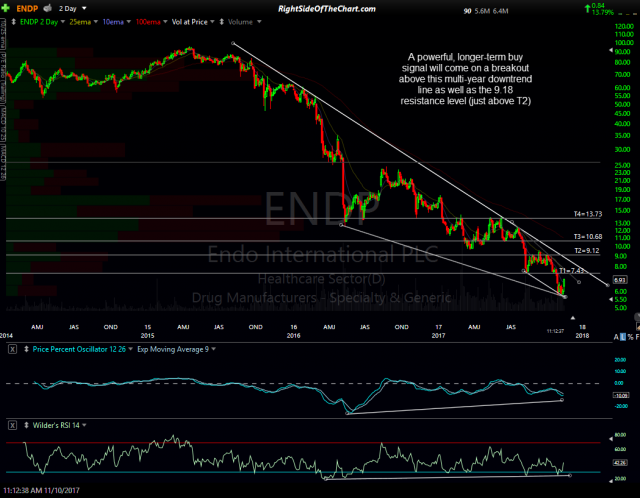

- ENDP 2-day period Nov 10th

- ENDP weekly Nov 10th

ENDP has confirmed bullish divergences on the daily time frame with powerful potential (unconfirmed) positive divergences forming on the weekly chart which indicate that an end to the vicious bear market in this stock may be close at hand. A powerful, longer-term buy signal will come on a breakout above this multi-year downtrend line as well as the 9.18 resistance level (just above T2)

The price targets are T1 at 7.43, T2 at 9.12, T3 at 10.68 & T4 at 13.73. The maximum suggested stop (if targeting T3 or T4) is any move below 5.60 with a higher stop suggested if only targeting T1 or T2. The suggested beta-adjustment to the position size is 0.80. The ideal entry range is 5.90 up to 7.00 (the stock is trading at 6.79 now as it has pulled back some since the screenshots above were taken around 6.92).