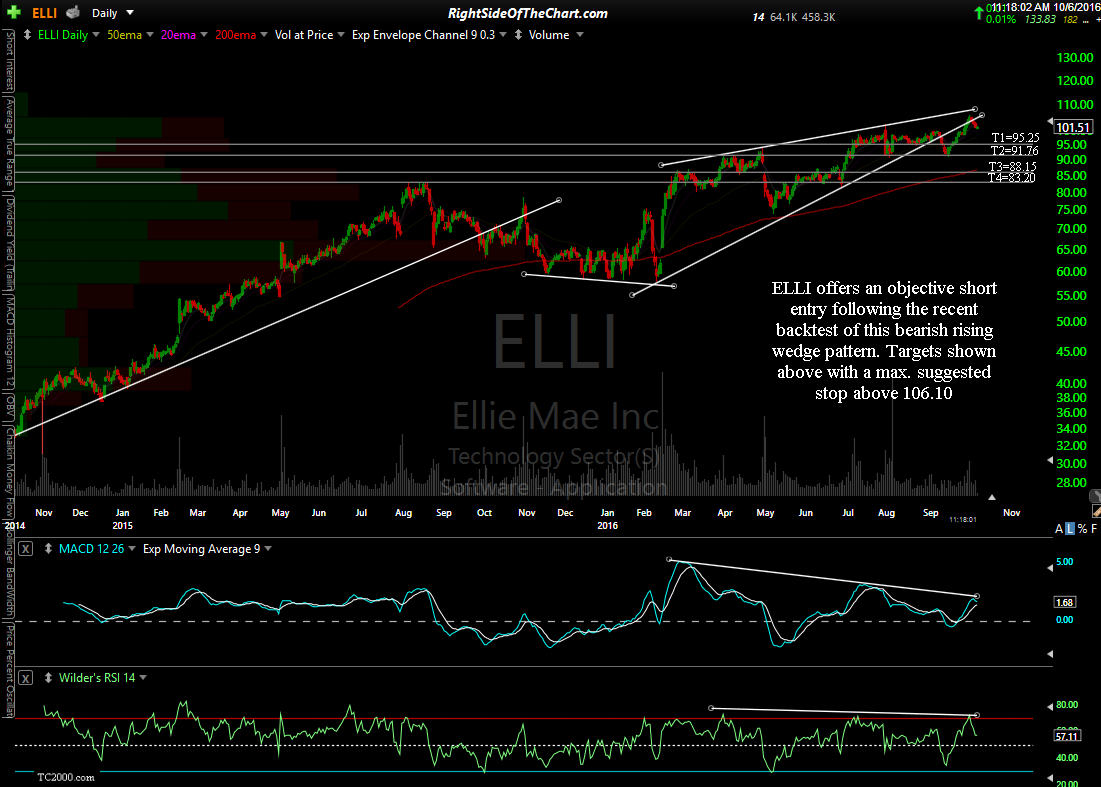

ELLI (Eliie Mae Inc) offers an objective short entry following the recent backtest of this bearish rising wedge pattern. Targets shown above with a max. suggested stop above 106.10 (lower, ideally using a 3:1 R/R if targeting any of the early price targets).

Keep in mind that swing trades, especially those in the technology sector, such as ELLI, run an elevated risk of having their stops clipped until & unless the broad market & especially the Nasdaq Composite makes a definitive break down below the recent sideways trading range. As such, each trader must decide which trades to take & which to pass on while some might opt to wait until some decent evidence that the market has started to move below or above the recent trading range.

Based on my read of the charts, my own preference is to start adding more short exposure here as in order to have at least partial positions in some of the best looking trade setups, which I can & will likely add to, should the charts confirm. I plan to add numerous new trade setups going forward as the possibility for a sharp & swift move out of this recent trading range is very possible. As such, I want to share as many trade setups in advance, some of which will be added directly as Active Trades, such as ELLI, while others might be posted as a setup with a specific entry trigger pending.