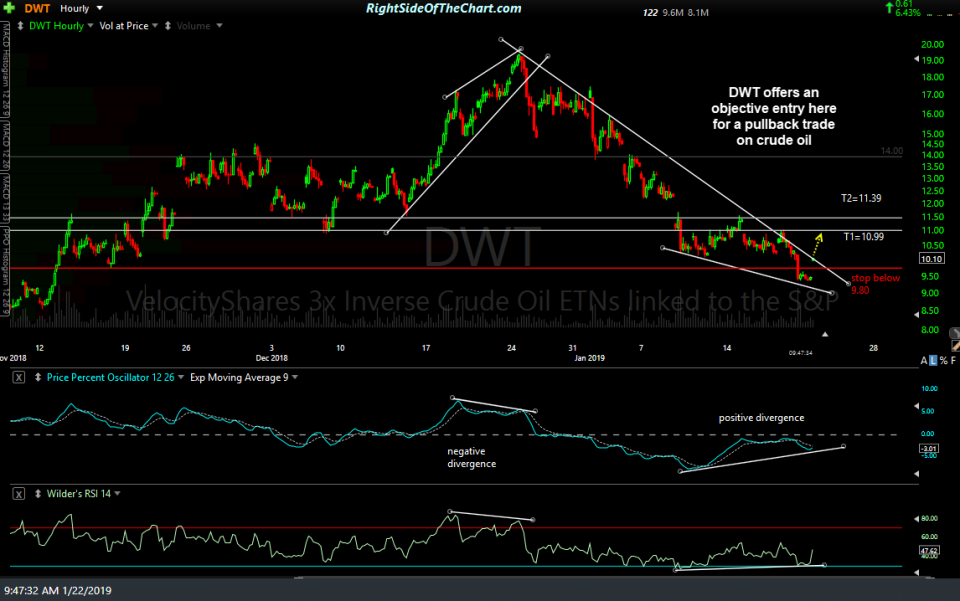

DWT (3x Inverse/Short Crude Oil ETN) offers an objective long entry for a pullback trade on crude oil & will be added as an Active Short* Trade around current levels. *As DWT is an inverse ETN, one would buy (i.e.- go long) DWT to short crude oil.

The price targets are T1 at 10.99 & T2 at 11.39 with a suggested stop on any move below 9.80. The suggested beta-adjusted position size on this trade is 1.0, which is essentially a 3x position size equivalent to a short on USO (1x long crude ETF). The reasoning for the oversized position is based on my confidence in this trade, my expectation for a relatively quick pullback trade and the fact that the suggested stop is set less than 3% below current levels, resulting in a relatively small loss if the trade is stopped out.

The basis for the trade is a breakdown below this 60-minute bearish rising wedge pattern that was posted in the trading room before the regular trading session opened today. I’ll post an updated chart in the comment section below as soon as I get a chance but wanted to get this trade posted & sent out asap).