The DWT (3x Inverse Crude ETN) short-term Swing Trade was stopped out on 60-min candlestick close (30.73) below 30.90 for a loss of 4% on Tuesday after the Saudi + OPEC joint announcements of production cuts foiled the falling wedge breakout. As DWT gapped down below the stop trigger & printed the first 60-minute candlestick close at 30.73, that is the price used in calculating the loss on this trade.

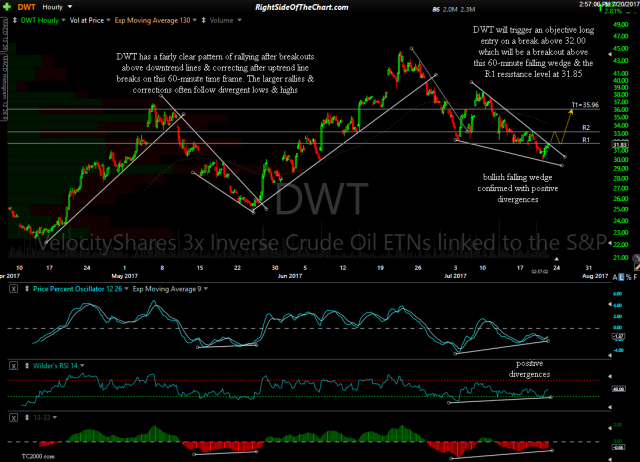

- DWT 60-minute July 20th

- DWT 60-minute July 21st

- DWT 60-minute July 27th

News can often trump the charts & this immediate reaction to the announcement of production cuts was unarguably the catalyst for that sudden & swift rally in crude oil. DWT & all posts related to this trade will be moved to the Completed Trades category although I am closely monitoring crude for another possible pullback trade as the charts are once again setting up for a potential pullback trade. Previous & updated 60-minute charts above.