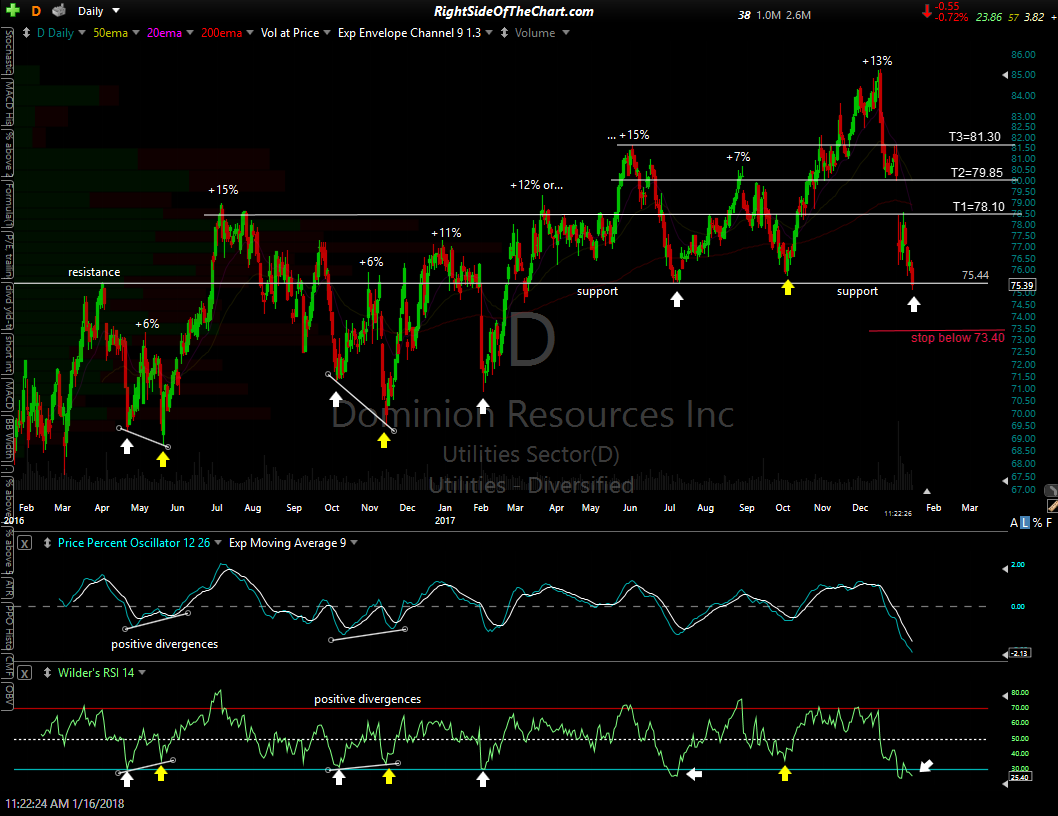

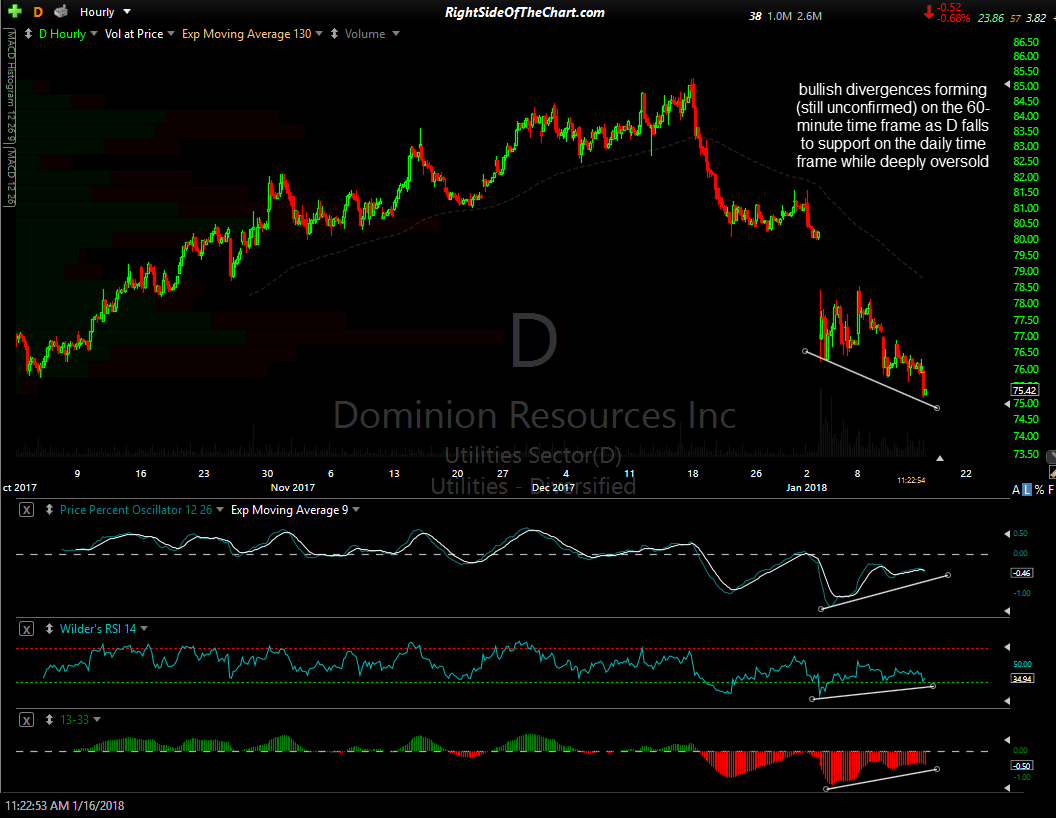

D (Dominion Energy Inc) is a utility stock that offers an objective long entry here as the with the stock trading at support while deeply oversold. Dominion will be added as an Active Swing Trade as well as a Growth & Income Trade as the stock is currently yielding 4.06%. Price targets are T1 at 78.10, T2 at 79.85 & T3 at 81.30. The suggested stop is any move below 73.40 with a suggested beta-adjusted position size is 1.2.

I’ve marked all oversold (30 or lower) RSI readings over the past two years with white arrows & the nearly oversold readings with yellow arrows along with the percentage gains on the rallies that immediately followed each of those oversold conditions. Essentially, the three primary criteria for this trade are: 1) Oversold 2) while at support 3) with bullish divergences forming on the 60-minute time frame. Those 60-minute bullish divergences are still unconfirmed but still indicate that the odds for a trend reversal are elevated at this time, especially when coupled with the fact that the stock is at support on the daily time frame while deeply oversold.