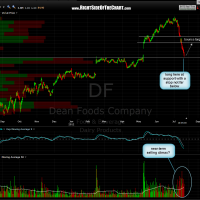

i’ve been kicking myself for days since i had planned to short DF when it hit my upper-most resistance line on this chart. actually, as per my usual M.O., i would have shorted just before that resistance level (2-day chart) but took my eye of this one as i took some time away from trading recently. would have been a nice quick gain but now i’ve taken some DF long for a potential bounce trade.

occasionally i will post some quick trade ideas for the more active/nimble traders. although this trade is the epitome of the proverbial “trying to catch a falling knife trade”, which means that you can get cut, even lose a few fingers if not careful, i think DF offers a good R/R long here with a stop not far below that support line. targets market on the 4 hour chart and being that i’m still taking quick profits, particularly on the long-side, i am currently favoring T1. again, this is a higher risk trade offering only about a 10% gain to the first target but i’ve written about what i refer to as “velocity” in trading. unless DF just stops here and flounders around these levels for a while, i’d expect to either be stopped out or hit my target(s) within a few days on this trade. 10% in a few days is better than 30% on a swing trade that lasts a month IMO, since i can quickly book those profits and redeploy that capital on the next attractive trade opportunity.