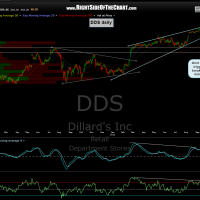

i’m spending some time today updating the trade setups and active trade ideas and in doing so, wanted to update DDS. this trade idea is now both a trade setup as well as an active trade since it recently triggered a short entry on the break below the rising wedge pattern but still offers a very objective entry here as it re-tests the wedge from below. i have added a support zone to the updated daily chart (2nd chart) and i also wanted to clarify the difference between support levels and targets.

if i list a support level on the chart of a short trade idea, it is because i believe that level is significant enough to likely act as support, even if only briefly, and possibly cause a decent bounce off that level once hit. however, i still expect the trade to continue lower to at least the first target before any substantial and lasting bounce, or possibly a resumption of the primary uptrend. these support levels might be useful for more active traders targeting quick profits or maybe micro-managing their position sizes around support and resistance levels throughout the duration of a longer-term swing trade. however, most swing traders can usually ignore these intermediate support levels on the short trades (ditto for the resistance levels such as R1, R2, etc.. on long-side trades).