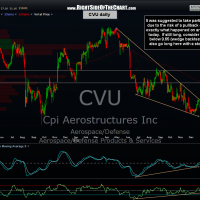

I decided to take the day off yesterday and plan to continue updating some of the trade ideas today. First on the list is CVU, which as I posted recently, hit the first target & I suggesting booking partial or full profits as a pullback off that level was high. Turns out it was an earnings miss, not the broad market that took it down hard today but nonetheless, the stock has made a very sharp gap lower from the T1 level and will thereby be considered stopped out and removed from the active trades list.

For those longer-term traders who might have held some or all of the position, here’s how I’d play it if caught on the wrong side of this gap (assuming that you pulled your stop this morning seeing the stock trading down so much in pre-market or you were using mental stops). I would now set a stop below 9.65-9.60, which is approximately the level where CVU backtests the bullish falling wedge pattern that it recently broke out from. From there, I would either set a trailing stop or continue to manually ratchet my stops higher, assuming the stock moves higher from here. More aggressive traders could even take a shot at a new long entry here (9.68) with a tight stop under 9.60ish as this large move could prove to be an over-reaction and a successful backtest of the wedge. Remember that this stock is also just above a key support level on the weekly time frame (see original post on the trade). I hope this helps for anyone who might still be in the trade and congrats to those who booked profits when the stock traded at T1 for the previous 3 consecutive trading sessions. Charts in order as posted: