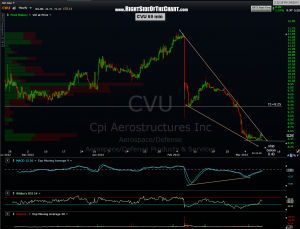

CVU was a recently completed long trade that was good for a 13.3% gain when the first target was hit on Feb 1st. The stock pretty much stopped cold at that resistance level where it consolidated before a big gap and crap move lower just a few days later. I’ve been keeping an eye on it since and it seems to be coiling near the apex of this falling wedge pattern on the 60 minute chart. As this is a volatile stock and one under heavy distribution at that, this would be considered an aggressive trade and best to consider a smaller than usual position size. The first and only target at this time is T1 (9.25) which is about 8.3% above current levels. Assuming the stock breaks out soon, around 8.60 today or maybe 8.55 on Monday due to the steep downtrend line, a stop below 8.40 would give this trade a downside of about 0.15-0.20 and an upside potential of 0.65-0.70 or slightly better than a 3:1 R/R. Based on my interpretation of the charts, I would expect this trade to play out rather quickly (1-5 days), assuming that it is successful.

CVU was a recently completed long trade that was good for a 13.3% gain when the first target was hit on Feb 1st. The stock pretty much stopped cold at that resistance level where it consolidated before a big gap and crap move lower just a few days later. I’ve been keeping an eye on it since and it seems to be coiling near the apex of this falling wedge pattern on the 60 minute chart. As this is a volatile stock and one under heavy distribution at that, this would be considered an aggressive trade and best to consider a smaller than usual position size. The first and only target at this time is T1 (9.25) which is about 8.3% above current levels. Assuming the stock breaks out soon, around 8.60 today or maybe 8.55 on Monday due to the steep downtrend line, a stop below 8.40 would give this trade a downside of about 0.15-0.20 and an upside potential of 0.65-0.70 or slightly better than a 3:1 R/R. Based on my interpretation of the charts, I would expect this trade to play out rather quickly (1-5 days), assuming that it is successful.

One final note. Regardless what happens today, I would not consider entering a position in CVU until at least next week. Late day breakouts, particularly on a Friday, are often prone to fail. Plus, I typically try to avoid entering short-term trades on a Friday with the additional overnight risk associated with the markets being closed over the weekend. Therefore, I wanted to share the setup in advance so those interest have time to review the charts but I will not consider this trade active until/unless a breakout is triggered after today.