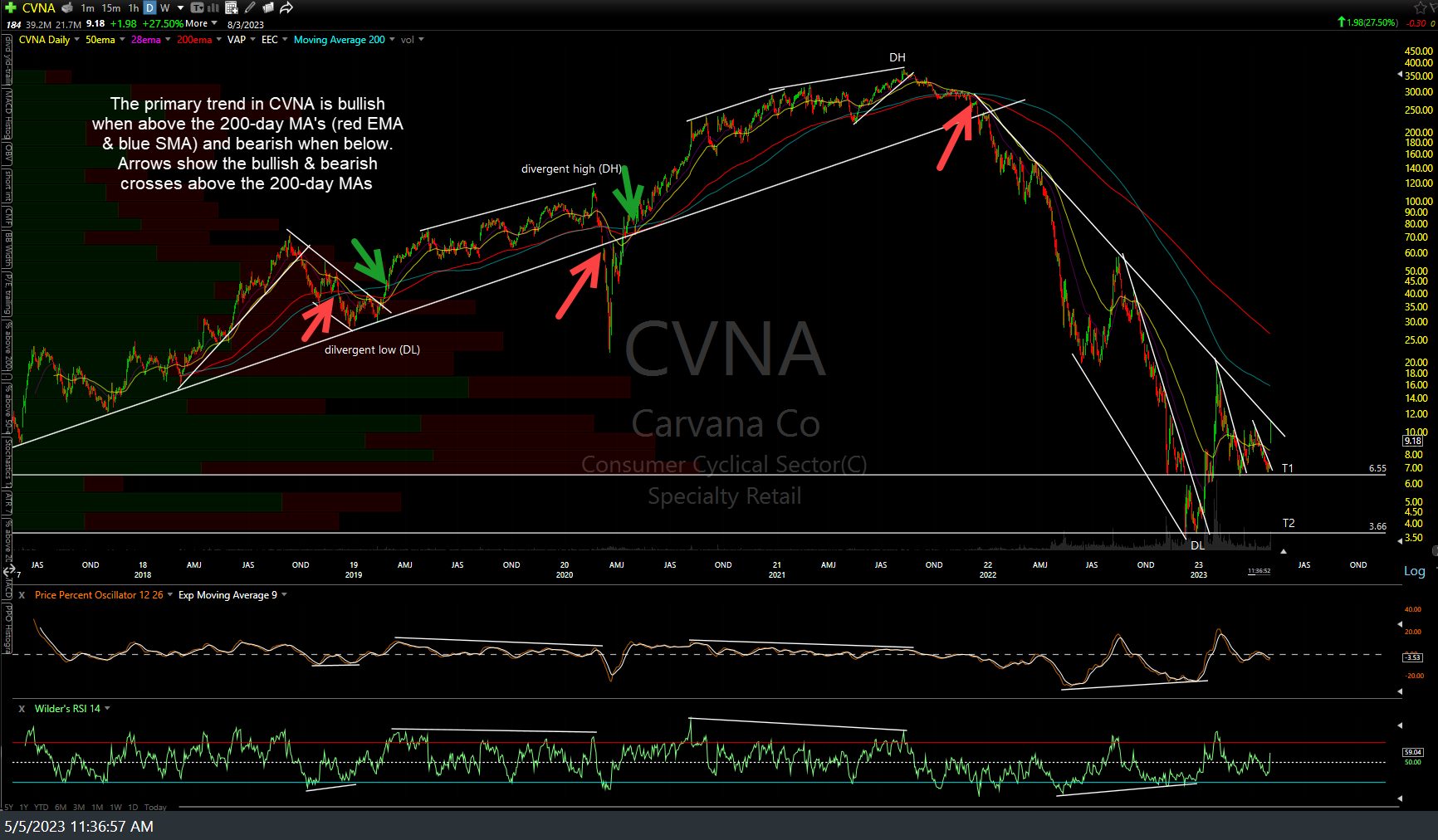

CVNA (Carvana Co.) offers an objective short entry here at the primary bear market downtrend line with stops somewhat above it, ideally on a solid daily closing basis. First two price targets shown on the daily chart below with additional targets likely to be added, depending on how CVNA & the broad market trades going forward.

The primary trend in CVNA is bullish when above the 200-day MA’s (red line is 200-day EMA & blue is the 200 SMA) and bearish when below. Arrows show the bullish & bearish crosses above the 200-day MAs.

Click here if interested in viewing a video that makes a compelling bearish case for not just the auto industry but also the banking sector that was handing out car loans like candy to kids on Halloween when all the beer flu stimulus money was flying out the door. My preference for long videos such as this is to set the playback speed at 1.5-1.75x.