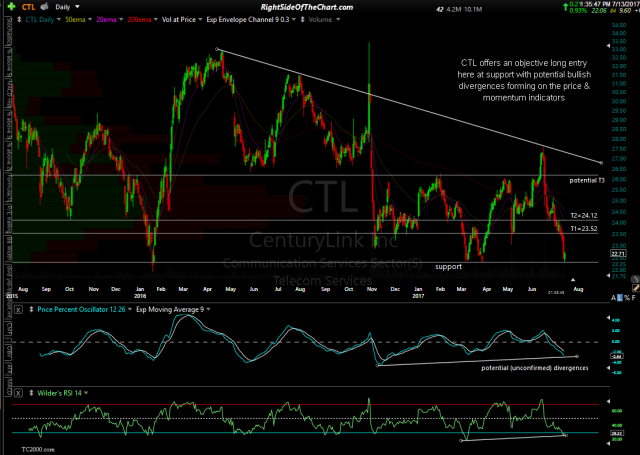

CTL (CenturyLink Inc) offers an objective long entry following this fourth tag of the 22.34ish support level since early 2016. CTL will be added as an Active Swing Trade as well as a Growth & Income Trade as the stock has a current dividend yield of 9.60%. Although prices have yet to break above it, this 60-minute bullish falling wedge pattern (2nd chart below) helps to confirm the entry on CTL at support on the daily time frame. A break above the wedge could offer an alternative entry or add-on to an existing position taken here.

- CTL daily July 13th

- CTL 60-minute July 13th

As with just about any stock with a dividend yield that is far above the average yield, there is usually some fundamental issues with the company as there are with CenturyLink & as such, the dividend runs an increased rate of being cut or possibly eliminated. Being that the stock has already fallen over 30% from the 2016 highs, the question have most or all (or even then some) of those issues already been priced into the stock? Another consideration is that assuming the dividend was cut in half or even by two-thirds, the stock would still have an attractive yield based on current rates.

One can debate the fundamentals, including the question above, all day long. Bottom line is the the R/R for a long position in this stock appears favorable here with a suggested stop below 22.00. The suggested beta-adjustment for this trade will be 0.90. Current price targets are T1 at 23.52, T2 at 24.12 & a potential third price target around the 26.20 level, depending on how the charts develop going forward.