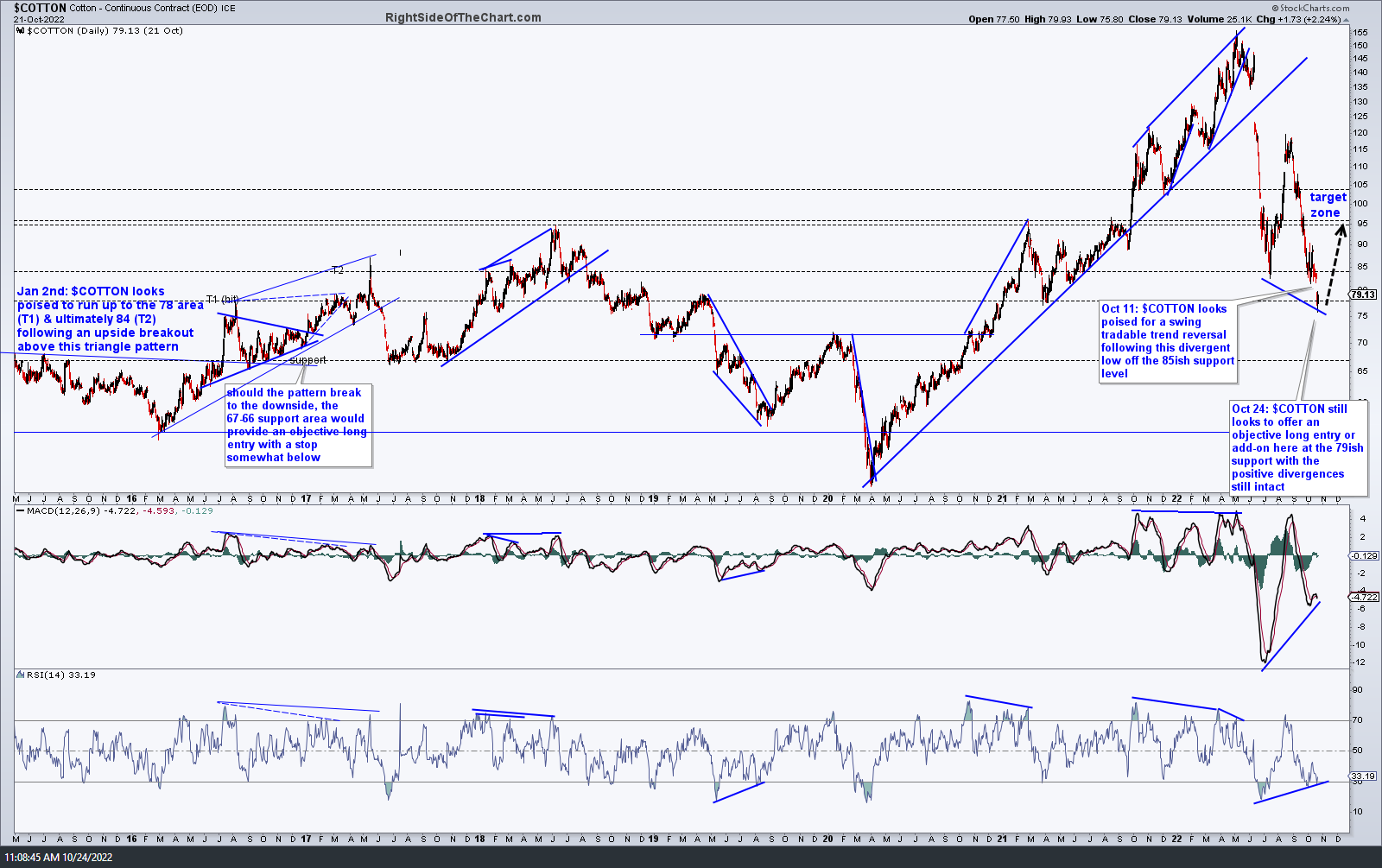

While cotton only made a brief consolidation around the 85ish support a couple of weeks ago followed by a gap down below it, $COTTON (continous futures contract) still looks to offer an objective long entry or add-on to an existing position here at the 79ish support with the positive divergences on the daily time frame still intact.

Zooming down to the 60-minute time frame, breakouts above the minor (blue) & primary uptrend line +0.8123 resistance level will likely spark a nice rally in /CT cotton.

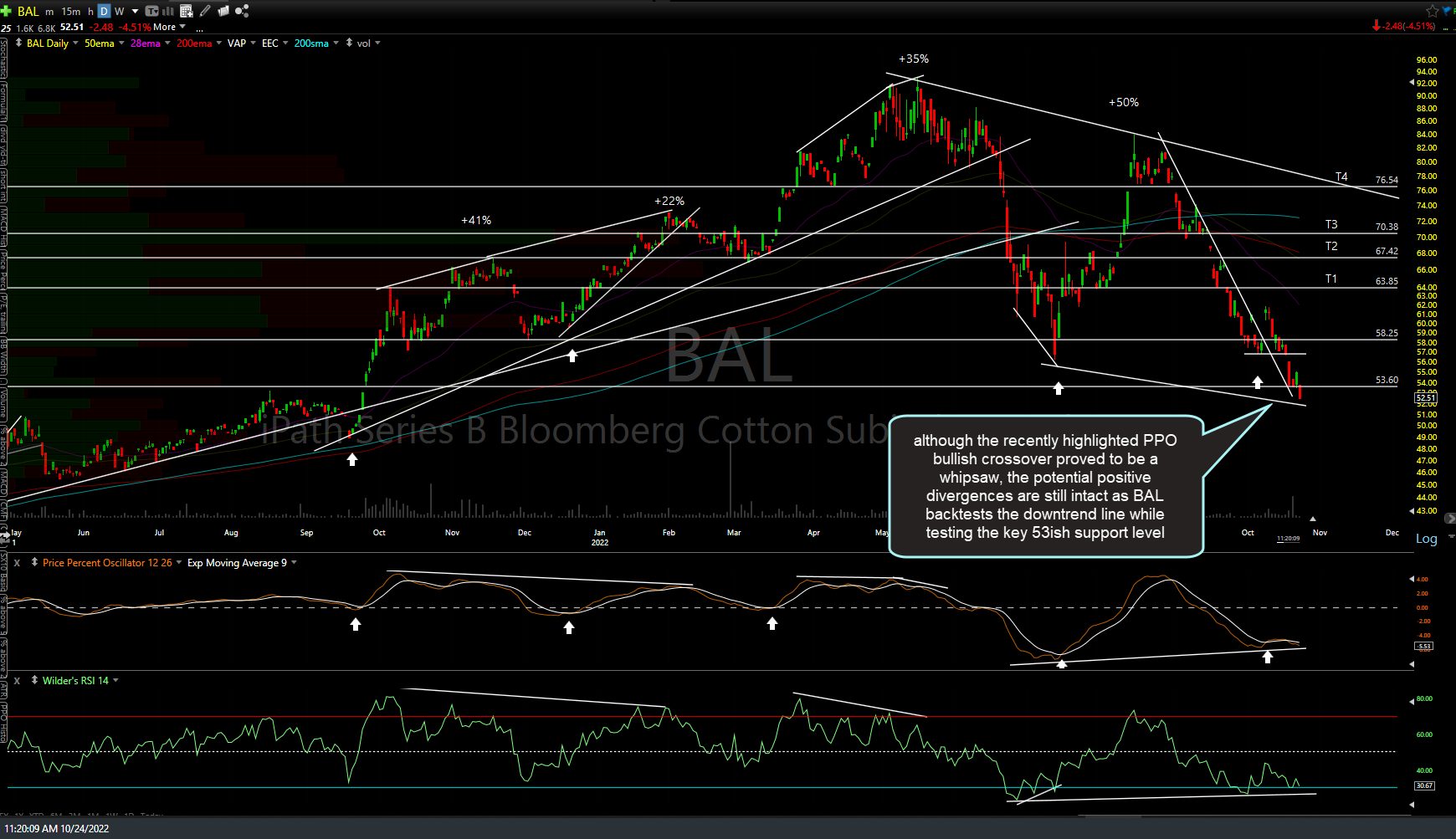

Although the recently highlighted PPO bullish crossover on the daily chart of BAL (cotton ETN) proved to be a whipsaw, the potential positive divergences are still intact as BAL backtests the downtrend line while testing the key 53ish support level.