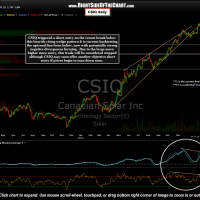

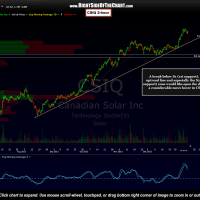

CSIQ triggered a short entry on the recent break below this bearish rising wedge pattern & is current backtesting the uptrend line from below, now with potentially strong negative divergences forming. Although a stop level for this trade was not previously suggested, CSIQ will be considered stopped out due to the large move higher since entry but may soon offer another objective short entry if prices begin to turn down soon. For anyone still short who might have entered CSIQ on the initial breakdown or on the first backtest of the pattern around 31.50 on Dec 20th or higher, consider a stop above the recent highs, maybe slightly above the 40 level. The fact that the RSI has already turned down from a second & lower overbought level (as shown via the RSI downtrend line) and the MACD is starting to roll-over (MACD downtrend line), CSIQ may very well be poised for a move down to the original targets on this trade. The 2-hour period chart below list two key support levels (uptrend line and horizontal support zone) which, if broken, would likely lead to the previous posted targets being hit.

- CSIQ Daily, Jan 10th

- CSIQ 2-hour, Jan 10th