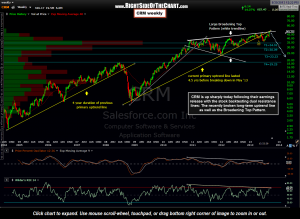

CRM was added as a long-term swing short candidate back on April 4th at a split adjusted price of 41.78. The stock made a large gap up today following their earning release which bring the stock just above one of the suggested stop areas. In that original post, a stop around the 48.40 level (around 3% above the previous split-adjusted highs) for those targeting T3 and more aggressive or more liberal stops for those targeting the earlier or final target (T4). At that time my preferred target was T3 but with my current expectations for considerable downside in the broad markets and also based largely on the bearish technical posture of CRM on the weekly chart (not to mention the fact the stock remains extremely overvalued) I’m starting to lean towards T4 as my final target which may be hit in 2014.

Although it’s still way too early to make that determination with any degree of certainty, I am giving my position on CRM a little more room on the stop than previously stated. This is in large part due to the fact that the stock has made an unusually large gap higher, with an extremely low probability that this is a continuation or break-away gap. More importantly, this gap has pushed CRM smack into two intersecting, key resistance lines: Both the top of the Broadening Top Pattern as well as a backtest of the recently broken long-term uptrend line. Unlike a rigid trading style, I prefer a more flexible & adaptive style which sometimes entails modifying my stops or profit targets from my original trading plan. Updated weekly chart above.