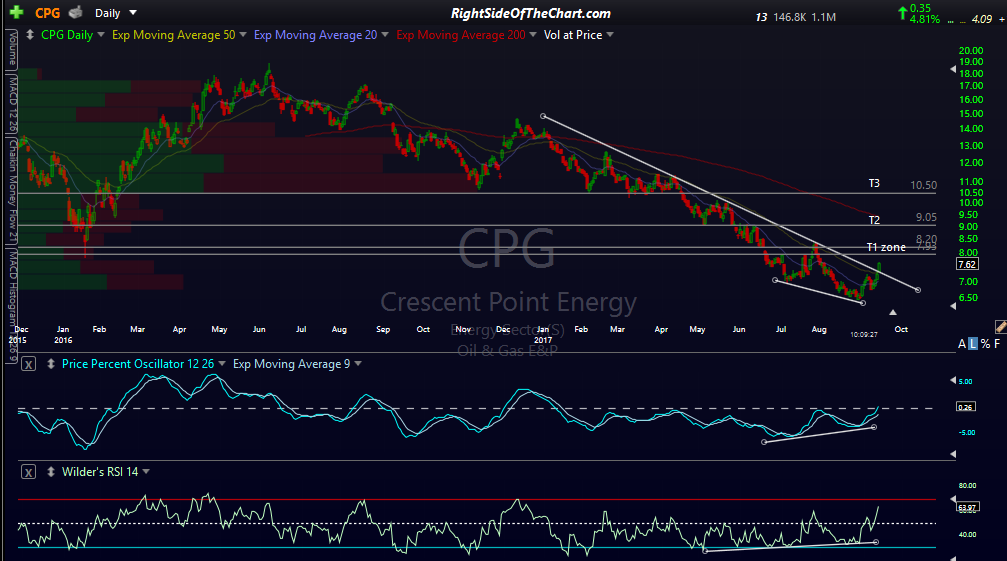

CPG (Cresent Point Energy) looks good up to any or all of these targets (unadjusted) on this breakout above the bullish falling wedge pattern, confirmed with positive divergences.

As I’m still behind on updating the official trade ideas, this will be an unofficial trade idea for now. Unadjusted price targets mean that those levels show on this chart are the actual resistance levels where a reaction is likely. Typically, I set my price targets and/or sell limit order(s) slightly below the actual resistance level in order to minimize the chances of missing a fill, should the stock reverse just shy of resistance.

The first target zone, again unadjusted, is a resistance zone that runs from 7.93 to 8.20 although I favor a move closer to the 8.20 level before the first decent reaction.