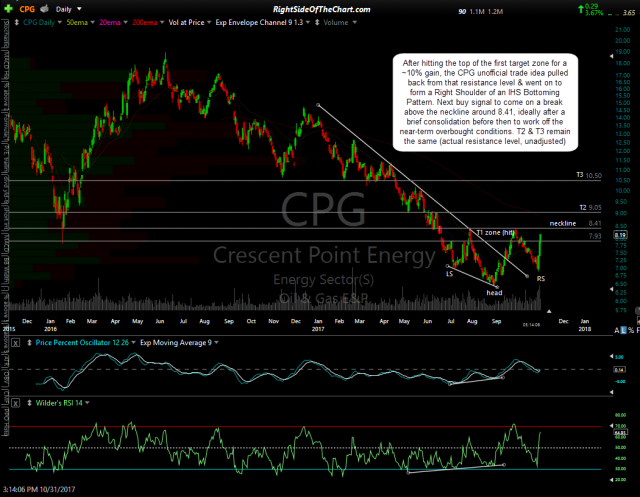

Props to member @jiunit23 to pointing out this potential Inverse Head & Shoulders bottoming pattern in the trading room today. CPG (Crescent Point Energy) was posted as an unofficial trade idea in this post on Sept 24th. After hitting the top of the first target zone for a ~10% gain, the stock pulled back from that resistance level & went on to form a Right Shoulder of an IHS Bottoming Pattern.

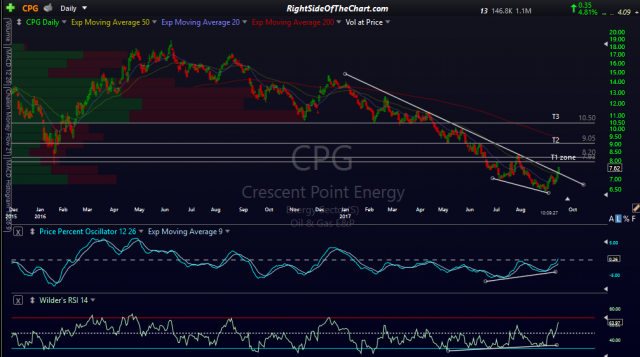

- CPG daily Sept 14th

- CPG daily Oct 31st

The next buy signal for CPG will come on a break above the neckline around 8.41, ideally after a brief consolidation before then to work off the near-term overbought conditions. Should that occur, Crescent Point Energy might be added as an official trade idea, along with more precise targets & a suggested stop. T2 & T3 remain the same (actual resistance level, unadjusted). Note the volume expansion on both advances during formation of the head and right shoulder, often overlook criteria for an Head & Shoulders bottoming pattern. Previous & updated daily charts above.