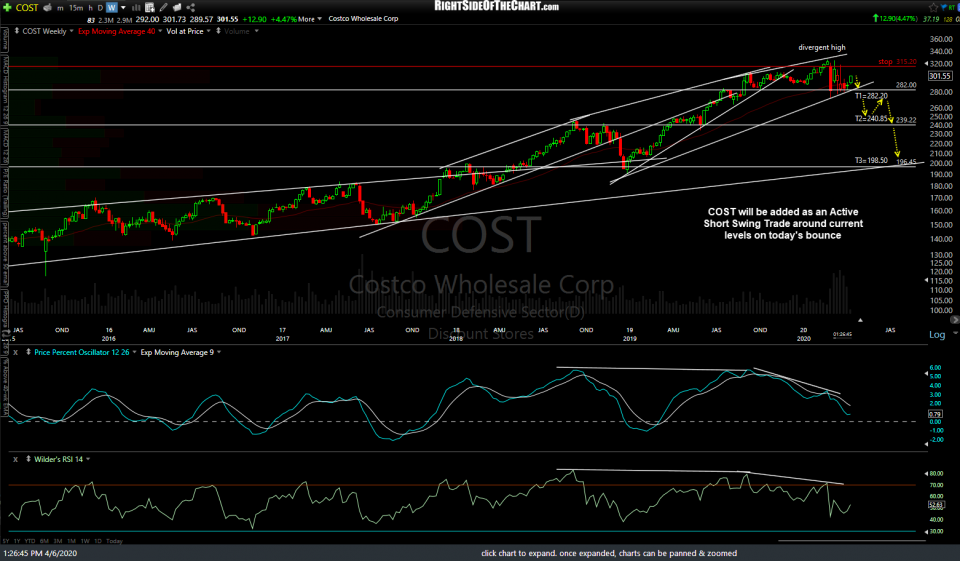

COST (Costco Wholesale Corp.) will be added as an Active Short Swing Trade around current levels on today’s bounce. I was originally planning to wait for a solid breakdown below the uptrend line & intersecting 282ish price support and although that would still offer an objective short entry or add-on to a starter position taken here, I like the fact that today’s rally in the stock market and COST may prove to be an ideal time to initiate a starter or full short position for what could prove to be a long-term swing trade with as much as a 35% profit potential.

The price targets for this trade are T1 at 282.20, T2 at 240.85 (my current preferred swing target), and T3 at 198.50 although I may revise that final target to the long-term trend line that is currently intersecting that price support level. The suggested stop of 315.20 provides a very attractive R/R of better than 4:1 for those targeting T2 as it is set less than 5% above current levels vs. a drop of over 20% if that second target is hit. The suggested beta-adjusted position size for this trade is 1.0. Weekly chart above.

A decent technical (charting) case can be made for a major trend reversal in COST following the large divergent high on the daily & weekly time frames, with solid break & weekly close below the uptrend line + 282 support to substantially firm up the intermediate to longer-term bearish case for the stock. Also, as discussed in some of the recent videos, I believe that a decent fundamental case can also be made for a long-term short position on Costco as there earnings going forward are likely to be impacted substantially due to the following changes as a result of COVID-19:

- In addition to the US & Canada on lock-down, as people are staying at home for all but essentially needs, Costco has also reduced store hours. While one might make a case that they could make up for lost in-store purchase with an increase in online sales, Costco’s business model hinges largely on impulsive purchases of a continually offering of new merchandise as well as premium cost food items (via the vendor samplings).

- In addition to the reduce store hours, Costco is also significantly limiting the number of members (customers) allowed in their warehouses at any time, further crimping sales.

- I suspect that the future earnings will be impacted by not only a drop in sales volume but as much, if not more so, from a shift towards more low-margin items such as toilet paper, water & essential food items (milk, eggs, meat, etc..) away from higher-margin goods & services such as TVs, furniture, vacation packages, etc..

- One thing that could work for or against the company is the revenue from recurring membership fees, which has traditionally been a big driver of Costco’s earnings & also helps to smooth out the bumps overtime via the fairly consistent revenue stream. If (and still a big IF) the US has only just started a recession that could last for a year or more, Costco could see a noticeable increase in membership cancellations. Maybe, maybe not but something to look for when the company reports their next quarter earnings & guidance on June 4th.

As always, pass on trades that don’t mesh with your outlook for the company, risk tolerance, or comfort level. As of now, COST is an Active (official) Short Swing Trade with an alternative, more conventional & higher-probability entry or add-on to come on solid break and/or weekly close below 282.