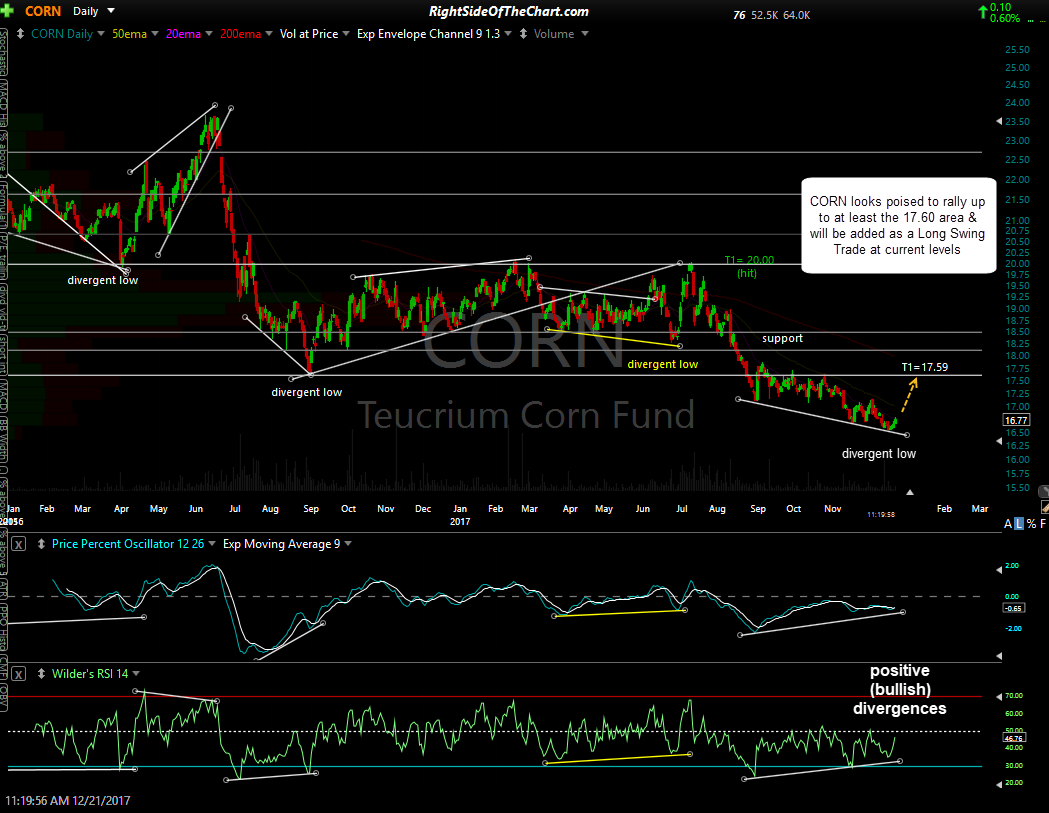

CORN (corn ETN) looks poised to rally up to at least the 17.60 area & will be added as a Long Swing Trade at current levels. The sole price target at this time is T1 at 17.59 with the possibility of additional price targets to be added, depending on how the charts develop going forward. The suggested stop is any move below 16.45 & with a suggested beta-adjusted position size of 1.2 (i.e. 20% above a typical swing trade position size).

For those preferring to use futures in lieu of the corn ETN, /ZC (corn futures) appear poised to rally up to the 360 level in the coming weeks following the recent divergent low & falling wedge breakout on this 60-minute chart.