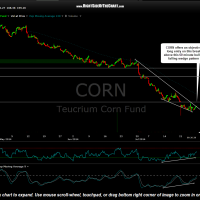

CORN (Corn ETF) offers a somewhat aggressive entry here on the break above this 60 minute bullish falling wedge pattern. CORN will also offer a second objective entry or add-on to an existing position taken here if & when prices move solidly (5 cents+) above the top of the July 21st gap (26.67). I refer to this current entry as somewhat aggressive for two reasons: First, that July 21st sizable gap is not too far overhead. Gaps, particularly large gaps, often act as support & resistance, especially on the initial tests of those gaps following their creation. Therefore, taking a long-side breakout in relatively close proximity to resistance may limit the upside potential on this trade, should prices ultimately fail to surmount the 26.67 level.

- $CORN weekly July 28th

- CORN daily July 28th

- CORN 60 minute July 28th

- island cluster reversal

The other reason that an entry here is somewhat aggressive is due to the fact that CORN might go on to backtest this 60 minute falling wedge at lower levels. As the weekly chart below highlights, $CORN (spot corn price) has been in a very powerful downtrend (actually, a third reason this is an aggressive entry) and is currently trading in what I call No-man’s Land, which is when a stock is trading in an area well above & well below any decent support and resistance levels. When trading these “catch a falling knife” trades, where a stock is in free-fall mode yet I believe a powerful trend reversal is imminent, I prefer the stock to be approaching a key support level on the weekly chart while setting up in a bullish chart formation on the daily and/or intraday charts. In the case of $CORN, the next solid support level (340ish) is about 8% below current levels.

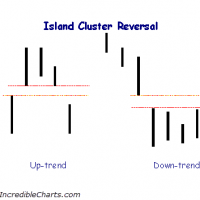

With that being said, I still see enough potential for a possible trend reversal from current levels to initiate a starter position in CORN (CORN ETF). An ideal scenario in the upcoming days would be a gap above the top of the July 21st gap (26.67), to put in place an Island Cluster Reversal bottom, with the “island cluster” being the group of candlesticks that were formed over the last week or so. That would be a very bullish technical event & one in which I would bring CORN to a fully position. As of now, my plan is to establish a partial position on the breakout of this 60 minute falling wedge, adding if and only if price move above the top of that July 21st gap (by at least 5 cents, to help avoid a false breakout). I plan to use a stop below 25.60 in case $CORN does want to go on to test that 340 weekly support level.

CORN is being added a both a typically swing trade entry & setup as well as a Long-Term Trade Idea & Setup, as this trade is based largely off the weekly time frame and has the potential to morph into a long-term trend trade with additional targets likely to be added, should we get some decent technical evidence of a likely trend reversal in the upcoming weeks. Long-term traders & investors might consider a wider stop that that suggested above for typical swing traders. A stop somewhat below the 340 level on the $CORN weekly chart would still provide an attractive R/R if target the top of the R2 zone which comes in around 550.