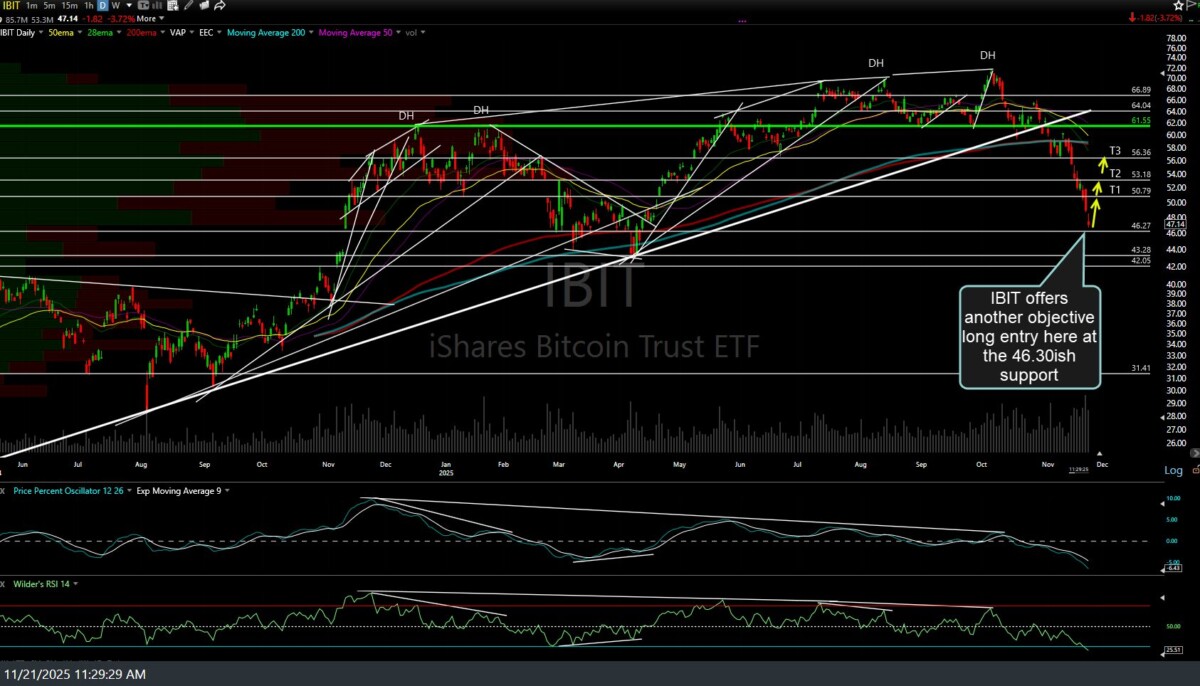

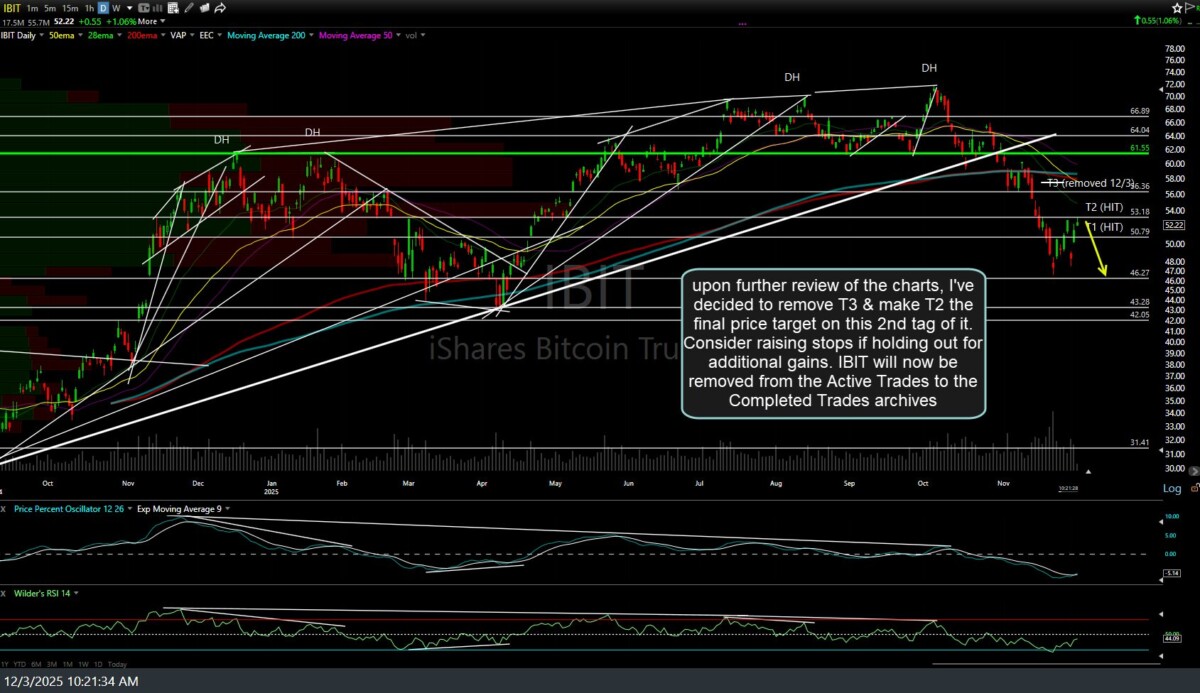

Upon further review of the charts, I’ve decided to remove T3 & make T2 the final price target on this second tag of it, providing another opportunity to book the quick 15% profit for those that didn’t do so on Friday. Those that are still long & looking for more upside, consider raising stops. IBIT will now be removed from the Active Trades to the Completed Trades archives. Previous & updated daily charts below.

My thoughts remain the same for the four crypto proxies that were posted along with Bitcoin as trade ideas at the recent lows (RIOT, COIN, MARA, & HIVE): I believe that we’ve sheared the bulk of the meat off the bone with quick gains of 25.-35% & most of those trades also re-testing (or close to) those same price targets that were first hit on Friday (hence, again providing objective levels to either book profits or raise stops, if holding out for additional gains).

While I’d still put about coin-toss (50/50) odds of the additional targets on those trades, as well as Bitcoin, being hit soon, the R/R isn’t as bilateral IMO, as a sudden reversal & resumption of the downtrend in Bitcoin, quite possibly in the overnight trading session (which would likely result in large gaps down on the crypto-proxy stocks, by-passing any tight stops) plays into my analysis & preference to be the “bull” & not the “hog” on this one*

*Bulls make money, bears make money, but pigs get slaughtered.