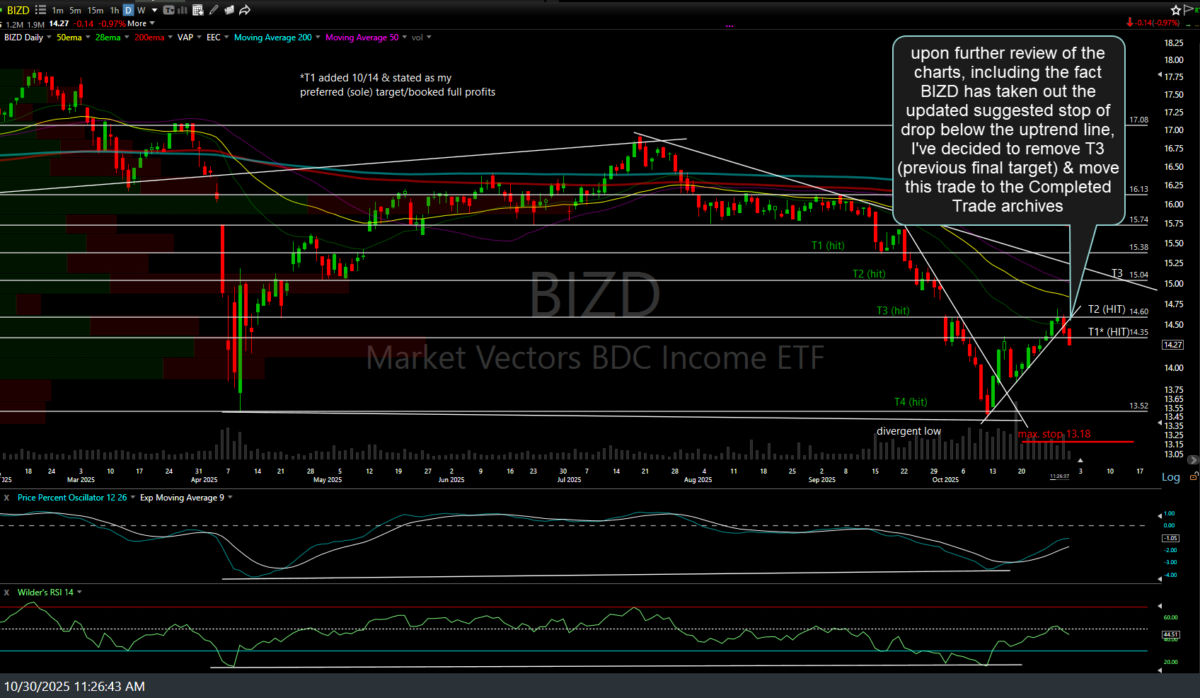

Upon further review of the charts, including the fact BIZD (BDC Income ETF) has taken out the updated suggested stop of drop below the uptrend line, I’ve decided to remove T3 (previous final target) & move this trade to the Completed Trade archives. Previous & updated daily charts below.

Besides my technical read on the sector, I still think there is a decent chance of another shoe (or multiple shoes) to drop in the private credit sector & as such, the R/R to keep this trade on as a long in the attempt to hit T3 while risking a sudden & potentially large drop, should another big credit event pop-up, just isn’t worth it IMO.

For those still in this trade & planning to hold out for more upside, I really don’t have any suggestions on a stop at this point, as the suggested stop I shared in the last update two days ago (a stop somewhat below the uptrend line) was already hit & should have taken anyone that didn’t book profits at T2 out with minimal give-back in profits from that second price target.

Time to start harvesting profits in most long-side trades that are correlated with the stock market or, at the very least, tighten up stops as it looks like things could start to get ugly going forward, especially if AAPL and/or AMZN shit the bed tonight.