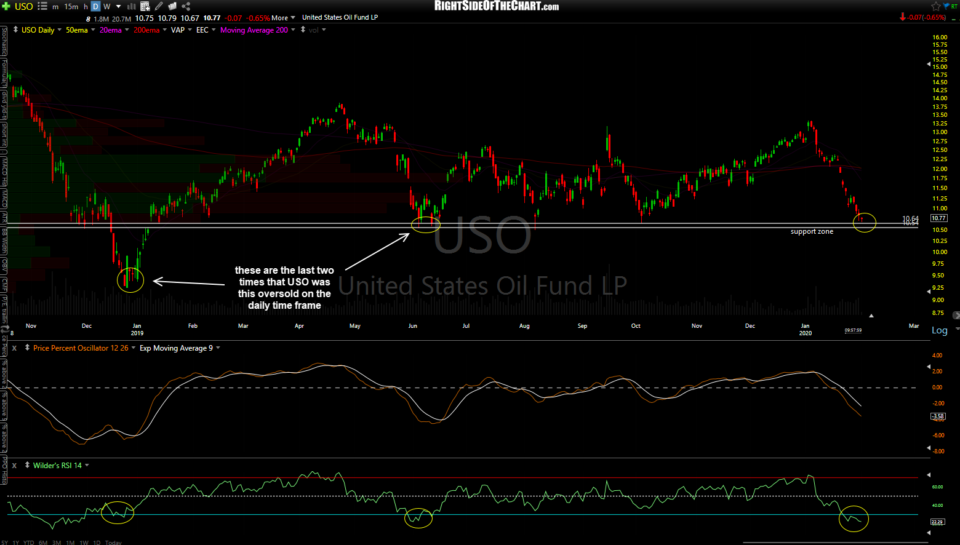

USO (crude oil ETN) offers an objective, yet aggressive entry here around support while coming off deeply oversold levels with potential bullish divergences forming & will be added as an Active Long Swing Trade around current levels. 60-minute & daily charts below.

- USO 60m Feb 3rd

- USO daily Feb 3rd

The price targets for this trade are T1 at 10.98, T2 at 11.18 & T3 at 11.44 with the potential for additional targets, depending on how the charts develop going forward. The suggested stop is based on a daily close below 10.37. If using USO, the official proxy for this trade, the suggested beta-adjusted position size is 0.90. If using UWT (3x long crude ETF) consider a beta-adjusted position size of 0.30 to account for the 300% leverage.

The daily chart of /CL above also shows crude futures at key long-term support around 50.40 while at rarely seen oversold levels that have been followed by rallies of 10% & 21% on the previous two tags of the 20ish level on the RSI. I may revise or add to some of the overhead price target/resistance levels on this 60-minute chart of /CL below but for now, these could serve as potential targets as well as an alternative entry (on a breakout above the downtrend line/falling wedge) for those that prefer trading futures.