/CL (crude oil futures) are now testing the 52.20 resistance level with a solid break and/or 60-minute close above that level likely to open the door to the next leg up to the 53.36 price target & quite likely the 54.75ish target as well.

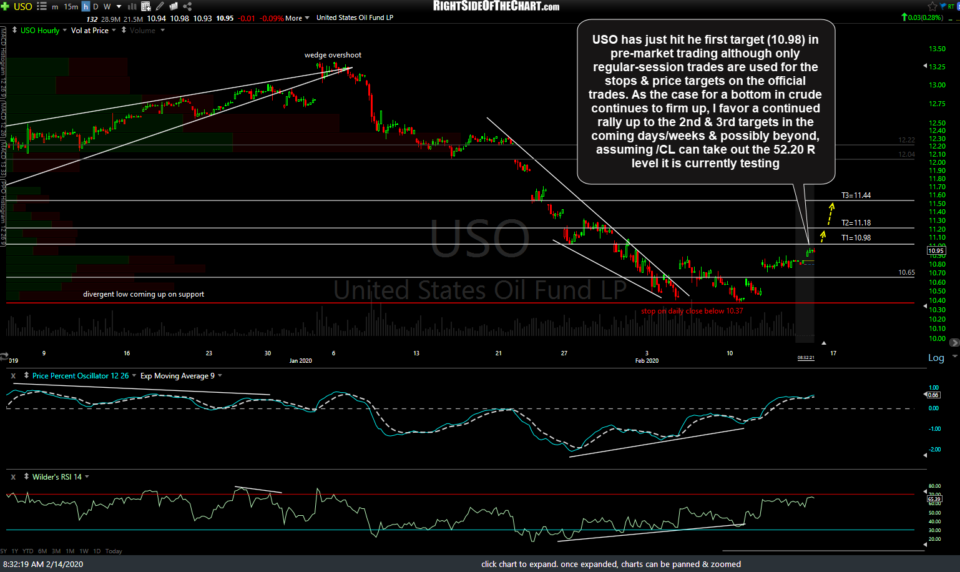

Likewise, the USO (crude oil ETN) has just hit the first price target (T1 at 10.98) in pre-market trading although only regular-session trades are used for the stops & price targets on the official trades. As the case for a bottom in crude continues to firm up, I favor a continued rally up to the 2nd & 3rd targets in the coming days/weeks & possibly beyond, assuming that /CL can take out the 52.20 R level it is currently testing. As I like to say; Resistance is resistance until & unless taken out so the best best for those looking to add to or initiate a long position in crude would be to wait for these resistance levels in /CL & USO to be taken out. One final consideration is that I’m still leaning towards at least a minor correction in the equity markets based on the recent breakdowns on the 60-minute charts. Should that occur, it may provide a headwind for crude oil. As such, a case can be made for either taking partial or full profits here are resistance/T1 or raising stops to protect profits.

For those trading UWT (3x bullish crude ETN) the 60-minute chart below has some potential unadjusted price targets. Unadjusted targets are the actual resistance levels were a reaction is likely upon the initial tag from below. Best to set your sell limit order(s) slightly below the actual resistance level(s) that you are targeting on a trade in order to minimize the chance of missing a fill, should the sellers step in a bit early. Also, it is best to align your entries & exits with the support & resistance levels on crude futures and/or the comparable 1x (non-leverage) ETF/ETN when trading leveraged ETFs/ETNs as the decay can often lead to distortions in the chart.