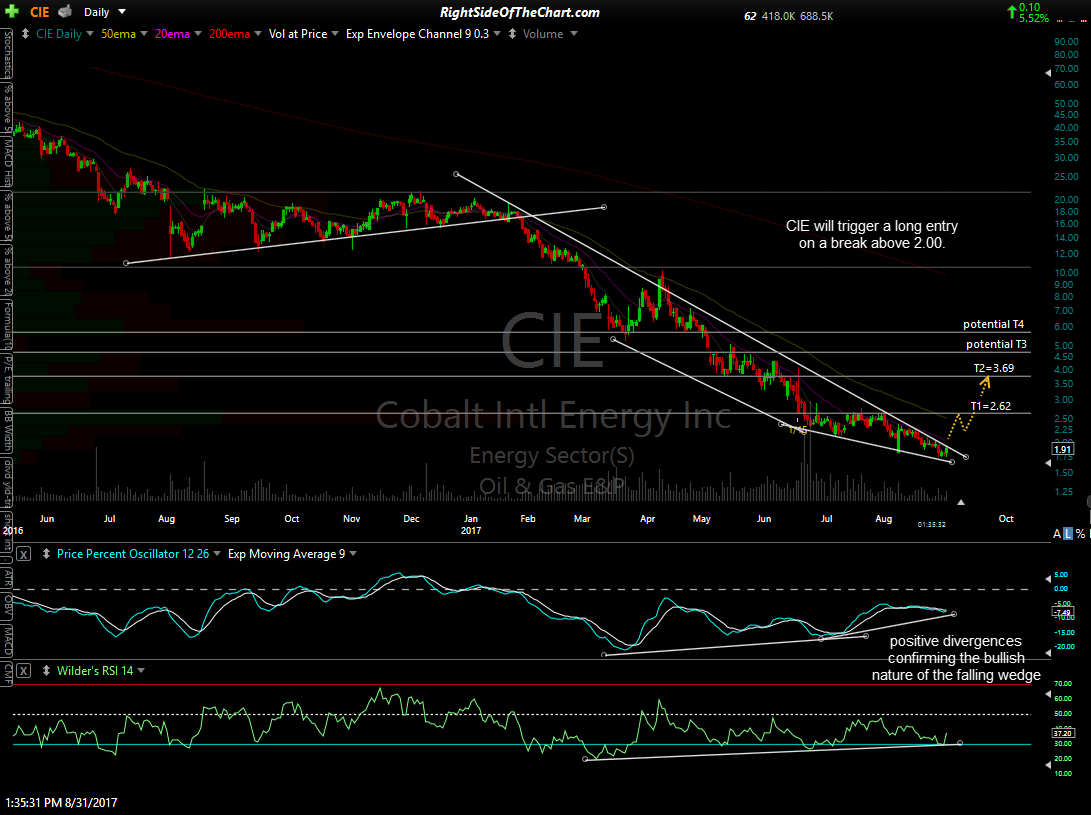

CIE (Colbalt Int’l Energy Inc) will trigger a long entry on a break above 2.00. That will have taken the stock above this bullish falling wedge pattern, confirmed with positive divergences, setting the stage for a potentially explosive rally ranging from 35% – 100% & possible more.

As a low-priced & often volatile energy stock, this should be considered a very aggressive trade. The current price targets are T1 at 2.62 & T2 at 3.69 with the potential for additional targets to be added of the charts of both CIE as well as the Oil & Gas Exploration & Production sector continue to firm up. Due the aggressive nature of this trade coupled with the expectation for very large price swings in this stock, the suggested beta-adjustment is 0.40 and the suggested stop for this trade is an move below 1.67.