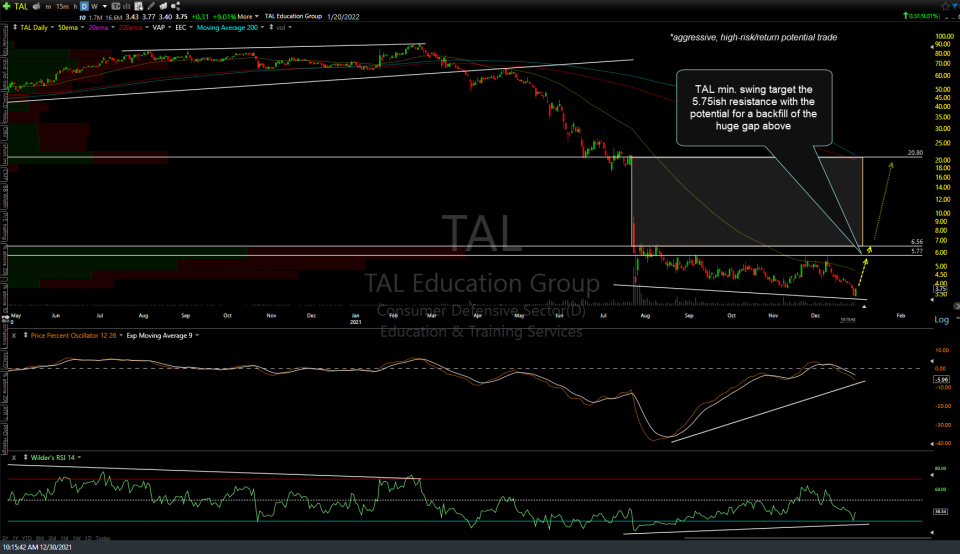

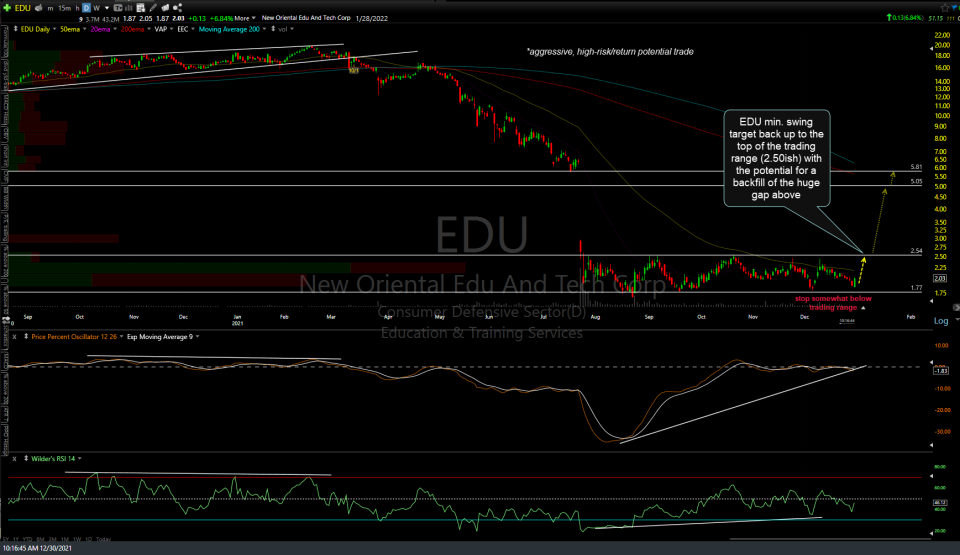

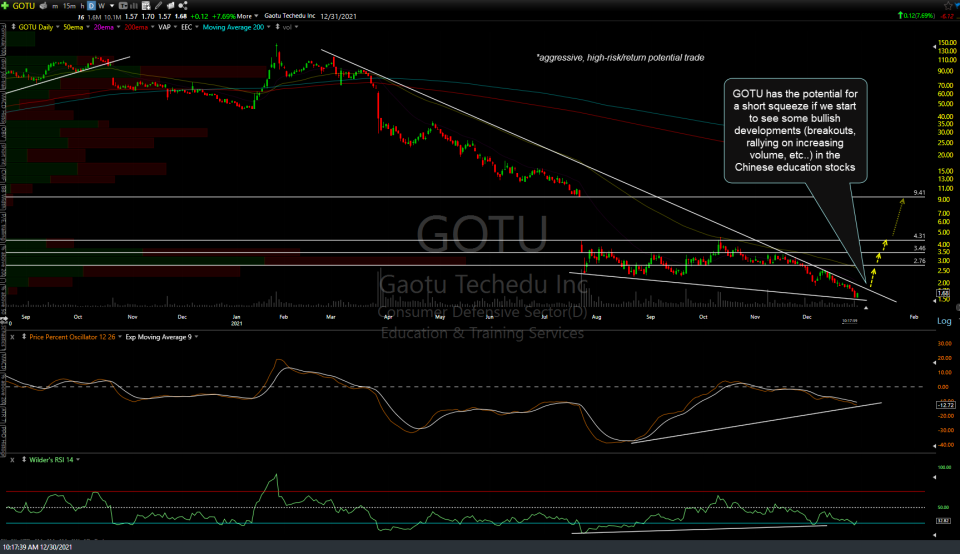

The Chinese education stocks have been left for dead following China’s crackdown on the sector this past summer. With class-action shareholder lawsuits piled up along with the threat of potential delistings of some of these stocks by the SEC, to say that the fundamentals outlook for these companies is dismal would be an understatement. With that being said, the following stocks all have strong positive (bullish) divergences building between price & the momentum indicators, some with fairly well-defined nearby support or resistance levels in which to provide objective long entries. It should also be noted that some of the stocks in the sector, such as GOTU & EDU have more cash on their balance sheet than their total market capitalization*. (*As per this Dec 8th article from The Motley Fool: That may or may not still be the case).

Bottom line: These trade ideas (some trade setups, some currently actionable trade ideas) are about as aggressive I’ll share on RSOTC. As such, pass if trying to catch falling knives on stocks with dismal fundamentals & low liquidity is not your cup of tea. If you are fine with carving out a small portion of your portfolio for aggressive trades, one strategy might be to take a shotgun approach by taking very small starter positions in the 5 stocks below, adding to those positions if & only if the technicals (charts) start to firm up. Ideally, I’d want to see the bulk of the stocks in the sector start to rally on increasing volume as well as taking out any of the nearby overhead resistance levels (price and/or downtrend lines).

The more conventional or, for lack of a better word, conservative strategy (as these would still be very aggressive trades) would be to wait to see if the aforementioned bullish developments begin to materialize in the sector (aka- the “second mouse gets the cheese” strategy). The advantage to that strategy is that you would have a lower chance of being stopped out for a loss with the downside being the potential for much less favorable entry prices if many of the stocks have made very large gains by the time it becomes clear that a short-squeeze is in play.

Arrow breaks on the charts of the following stocks below are potential price targets: COE, TAL, EDU, GOTU, & YQ.