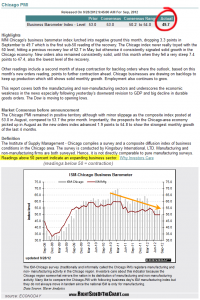

as you can see from this chart, the chicago PMI has clearly been trending lower for nearly two years now. however, although that that downtrend indicated a deceleration, or slowing of growth, the index remained above 50 (expansion) every single month until now. this morning’s release shows the index has now fallen to a level of 49.7, the first sub-50 contraction reading in 3 years. as i always say, any one particular set of data points does not make a trend, nor does a sub-50 PMI reading alone mean too much. however, taken together with other economic indicators, this reading only helps to affirm that the US economy is clearly deteriorating. yes, trends do not continue forever and it is quite possible that the reason the stock market is barely off multi-year highs is that it is doing it’s usual job of looking out 6 to 9 months ahead and pricing in what could be a very strong rebound in the US economy just around the corner.

as you can see from this chart, the chicago PMI has clearly been trending lower for nearly two years now. however, although that that downtrend indicated a deceleration, or slowing of growth, the index remained above 50 (expansion) every single month until now. this morning’s release shows the index has now fallen to a level of 49.7, the first sub-50 contraction reading in 3 years. as i always say, any one particular set of data points does not make a trend, nor does a sub-50 PMI reading alone mean too much. however, taken together with other economic indicators, this reading only helps to affirm that the US economy is clearly deteriorating. yes, trends do not continue forever and it is quite possible that the reason the stock market is barely off multi-year highs is that it is doing it’s usual job of looking out 6 to 9 months ahead and pricing in what could be a very strong rebound in the US economy just around the corner.

however, this may be, and i feel strongly that it is, one of those rare and golden opportunities where there is an unusually large disconnect between equity prices and their underlying fundamentals, i.e.- stocks are extremely overvalued. just to clarify, i don’t base my valuation on current (which are really past) earnings. if a recession in the US is either upon us or just around the corner, earnings estimates (and actual earnings) will quickly began to fall, thereby causes stocks to become overvalued at current levels. in fact, several key companies, such as FDX, have already begun the process of downward revisions in their earnings forecast.

the best trades come when both the fundamentals and technicals line up to confirm each other and as the case for both has been made ad nauseam here lately, i believe that sooner than later, the markets will experience that “point of recognition” where reality sets in. the popular consensus, even amongst bears, seems to be that because it is an election year, that the “powers that be” will hold the market up at least until the elections. however, that’s a pretty crowded trade/belief, and things tend to get ugly when everyone piles on one side of the market or the other.