CF (CF Industries Holdings Inc) is a fertilizer stock that has seen a lot of pricing pressure in its nitrogen business lately, the worst of which may or may not be fully reflected in the 67% drop in CF’s share price over the last year. CF is scheduled to report earnings after the market close today so I’ll wait to see how the stock trades tomorrow before listing the official entry criteria, profit targets & suggested stop for this trade but I did want to pass along this setup in advance for those that might be interested in rolling the dice on a potential short-squeeze trade as well as any Growth & Income investors that might want to start scaling in with a fractional starter position today before the stock reports earnings (my plan).

CF is currently yielding an attractive 4.91%, although there are no guarantees that the company will be able to continue to support the current dividend, especially considering the pricing pressures currently facing the fertilizer industry. Fundamentals aside, from a technical perspective, CF appears to be setting up within a bullish falling wedge pattern complete with positive divergences in place on the most recent low in both the MACD & RSI (daily chart).

- CF daily Aug 3rd

- CF weekly Aug 3rd

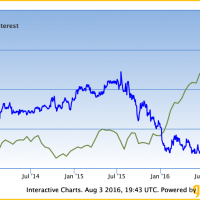

- CF short interest

From a longer-term perspective, CF is trading around a fairly significant support zone that runs from about 22.25 -24.00 (current price is 24.57). The bullish falling wedge can also be view on this time frame as well. One other potential bullish development is the extreme high short interest which has surged to about 29MM shares or 12.34% of the total float (shares available for trading). The high short interest coupled with the potential bullish setup on the charts tilts the odds in the favor of a positive reaction to whatever quarterly results & forward guidance CF issues after the market close today.

Once again, CF is only an unofficial trade idea at this time and any position taken in advance of earnings should be considered speculative, as the stock could experience a large gap in either direction when the market opens tomorrow. Additional commentary to follow tomorrow.