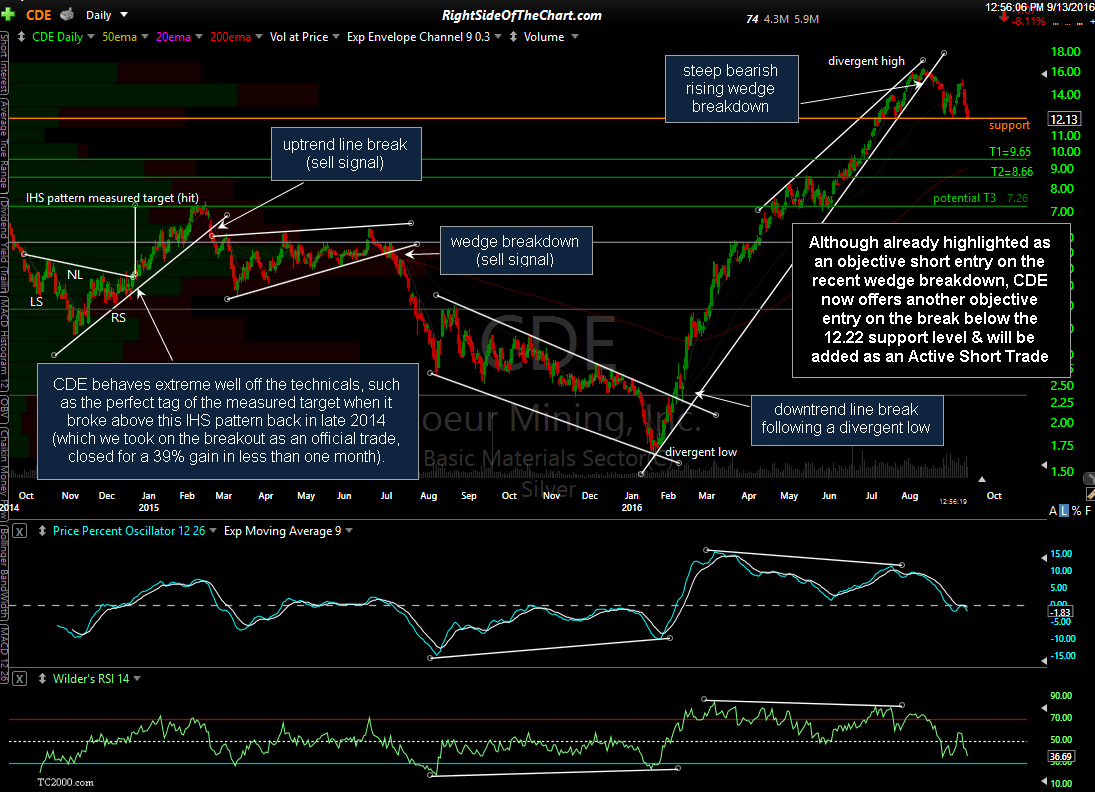

Although already highlighted as an objective short entry on the recent wedge breakdown, CDE (Coeur Mining Inc) now offers another objective entry on the break below the 12.22 support level & will be added here as an Active Short Trade. Current price targets are T1 at 9.65 & T2 at 8.66 with a potential third target around the 7.30 area which may be added, depending on how the charts of CDE, GDX, SIL, GLD & SLV play out going forward. The suggested stop is any move above 13.10 with a Suggested Beta-Adjustment of 0.5.

As the chart above illustrates, CDE behaves extremely well off the technicals, such as the perfect tag of the measured target when it broke above this IHS pattern back in late 2014 (which we took on the breakout as an official trade, closed for a 39% gain in less than one month). CDE was most recently highlighted as one of the most promising short trade setups in the mining sector in this Gold Mining Sector Overview video posted on July 24th, just before CDE broke down below the large rising wedge pattern, falling about 24% from that breakdown level so far.