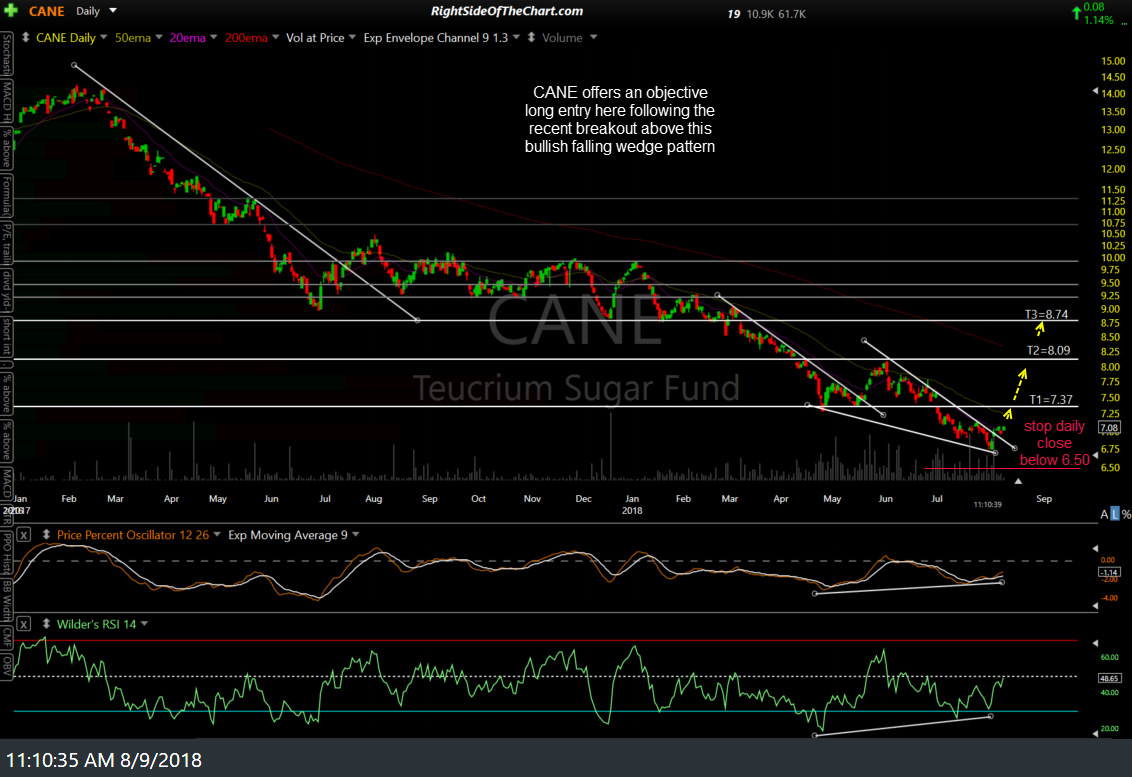

CANE (Sugar ETN) offers an objective long entry here following the recent breakout above this bullish falling wedge pattern & will be added as an Active Long Swing Trade at current levels.

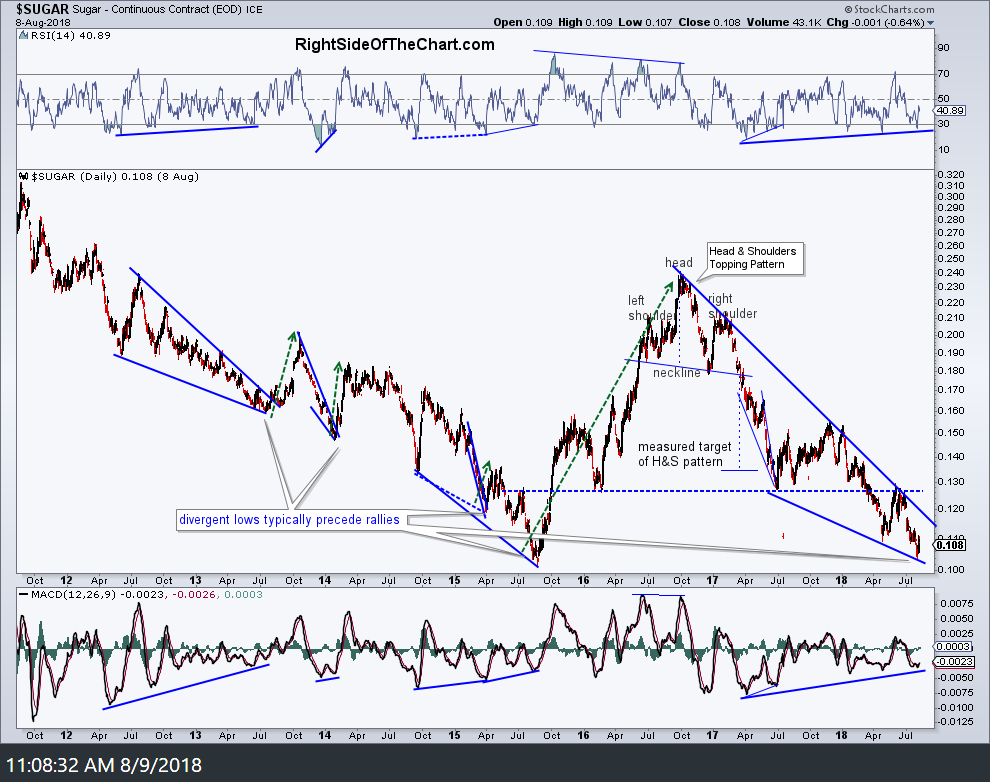

The chart below is a 7-year daily chart of $SUGAR (continuous futures contract) highlighting the current divergent low as well as the four previous divergent lows, each of which was followed by rallies of 25%, 25%, 15% & 138%.

Not only are the current divergences some of the largest in recent years but $SUGAR has also fallen to the technically significant 0.10 – 0.11 support level, which has produced numerous reaction from above & below as highlighted on the weekly chart below.

The price targets for CANE are T1 at 7.37, T2 at 8.09 & T3 at 8.74. The suggested stop (if targeting T3) is a daily close below 6.50. The suggested beta-adjusted position size for this trade is 1.0.