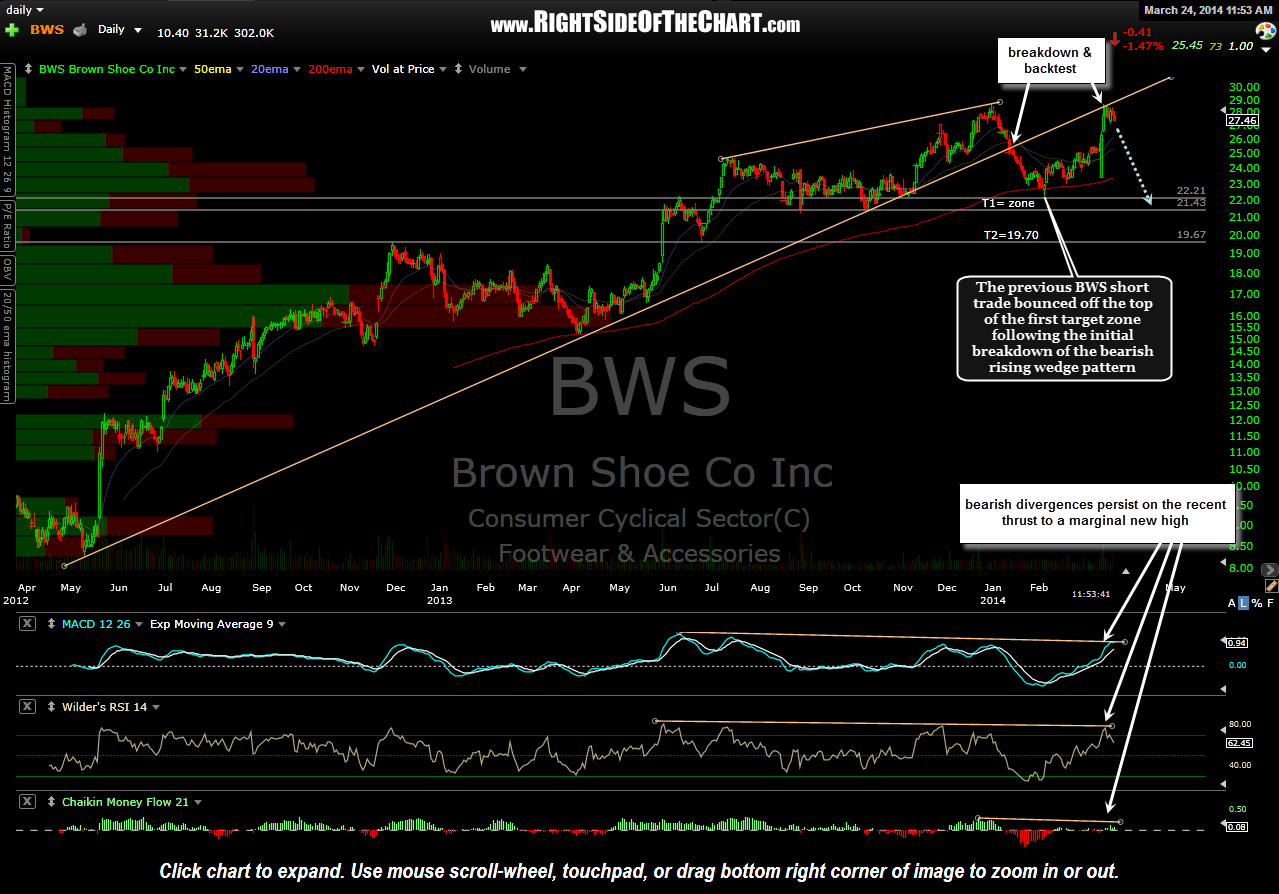

BWS (Brown Shoe Co. Inc.) was added as a short trade setup back on Thursday Jan 9th and went on to trigger a short entry two trading sessions later on Monday Jan 13th on the break below the bearish rising wedge pattern. From there, the stock went on to hit the top of the first target zone (T1 zone) on Feb 5th before immediately reversing and just recently exceeding the previously suggested stop of 27.60. Therefore, that previous short trade (and all associated posts) will be move to the Completed Trades category while BWS will also be added back as a new Active Short Trade & Short Setup here at currently levels following the recent successful backtest of the bearish rising wedge pattern from below.

On that backtest, which occurred early last week (and only about a point above the suggested stop on the previous trade), BWS managed to eek out a slightly marginal new high of only 3 cents above the previous reaction high from Dec 31st. While prices made that higher high during the backtest last week, most of the price & momentum indicators made lower highs, i.e.-the negative divergences that were already in place on the bearish rising wedge pattern continue to persist & have grown even larger in scope. This, coupled with the recently successful backtest of the pattern, provides another objective short entry on BWS with a stop somewhat (2-3%) above the recent highs of 28.73. Price targets will remain the same as with the previous trade with the first price target defined by the support zone that runs from about 21.45 – 22.30 and the second target (T2) at 19.70.