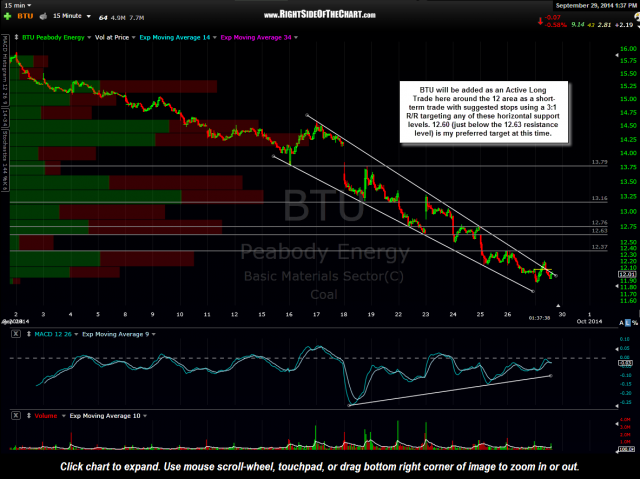

BTU (Peabody Energy) will be added as an Active Long Trade here around the 12.00 level. Multiple overhead resistance levels, all of which are potential targets on this trade, are listed on this 15 minute chart. As with the WLT coal stock trade, this should be considered a very aggressive, counter-trend

Although this is a short-term, oversold bounce trade based off the 15 minute time frame, BTU has the potential to morph into a longer-term bottom swing or trend trade. Recent volume pattern look capitulatory although we still need to see some decent evidence of a reversal or bottoming process on both the daily & weekly time frames before saying with any degree of confidence that the relentless selling in the coal stocks has likely run its course. With that being said, longer-term traders & investors could certain begin scaling into select coal stocks and/or the coal etf, KOL, which was recently added as a Long-Term Trade Idea (click here to view the charts & notes on that recent KOL entry & setup).