/BRR (Bitcoin futures) or IBIT (Bitcoin ETF) still offers an objective long entry here above the 81320 support with stops somewhat below with a current max. swing target of just below the 89066 resistance level, as covered in today’s earlier video. 120-minute chart below.

The IBIT (Bitcoin ETF) active swing trade is likely to make a run back up to the 52-53ish resistance, should it break above above this triangle pattern (downtrend line) to the upside while a downside break below the triangle pattern (uptrend line) would likely trigger a resumption of the downtrend line, taking IBIT down to the next downside swing target (T4), especially if T3 is taken out. While a breakout would provide an objective long entry or add-on, IBIT (as with /BRR) current offers an objective long entry here at support. 60-minute chart below.

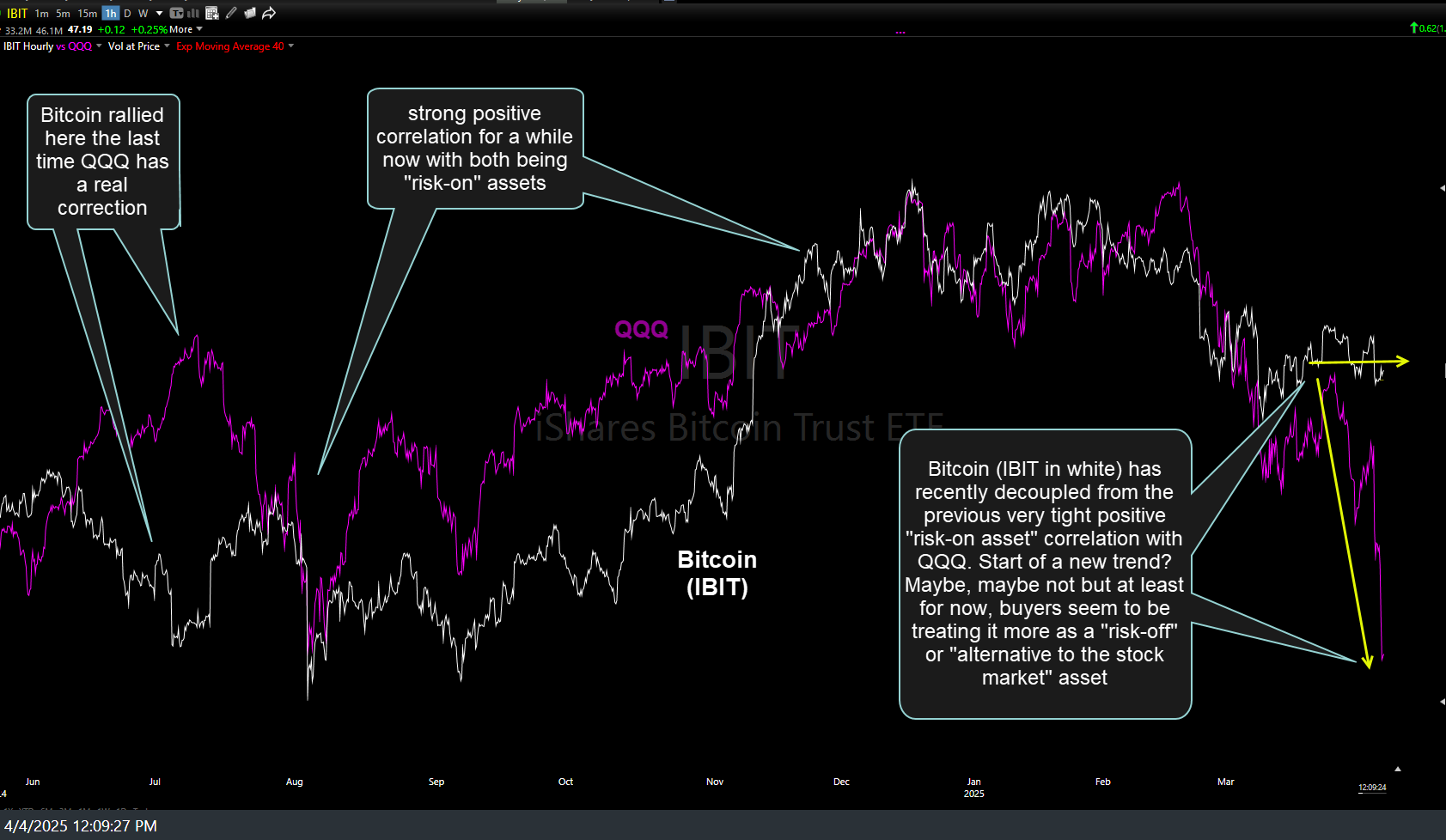

Bitcoin (IBIT in white) has recently decoupled from the previous very tight positive “risk-on asset” correlation with QQQ. Start of a new trend? Maybe, maybe not but at least for now, buyers seem to be treating it more as a “risk-off” or “alternative to the stock market” asset and should the stock market rally today or next week, I would also expect Bitcoin to rally along with it. 60-minute chart showing the on-off correlation between Bitcoin & the Nasdaq 100 below.