GBTC (Grayscale Bitcoin Trust) offers an objective yet aggressive short entry here in anticipation of a break below this bearish rising wedge pattern and/or (add-on to a partial position taken here) on a solid break below it. 60-minute chart below.

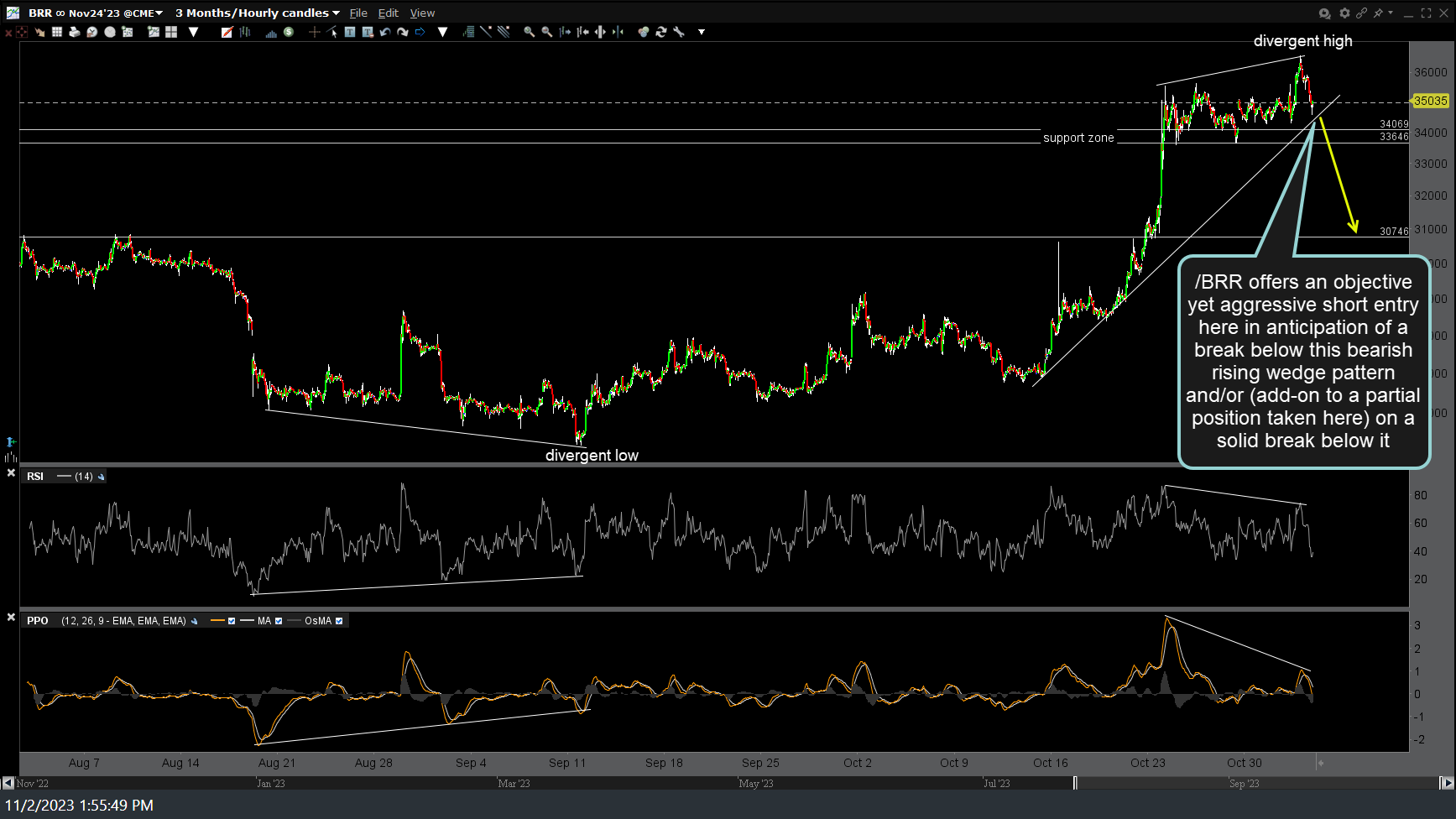

Ditto for /BRR (Bitcoin futures) which also has negative divergence on this 60-minute time frame & a bearish rising wedge pattern in which to trigger an objective short entry or add-on (for aggressive traders opting to take a starter position here in anticipation of what appears to be a likely & imminent breakdown IMO).

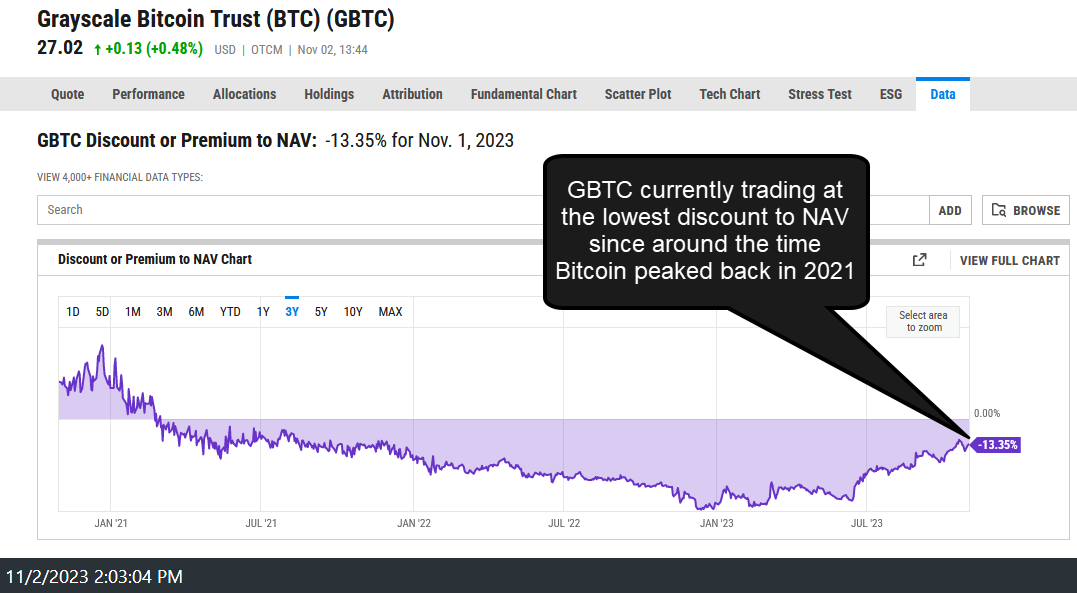

Note: GBTC typically trades as a premium or discount to the actual value of Bitcoin, having traded only at a discount since THE top in Bitcoin back in early 2021. Currently, GBTC is trading at the lowest discount to NAV since the major peaks back in 2021. Hence, this could help to explain why my final target on GBTC (just above the 21.42ish support & intersecting uptrend line) would provide for a 20% drop (profit), if hit, while my comparable price target on /BRR would only account for a ~12% profit, if hit. The discount on GBTC is likely to widen soon if my call on an impending correction pans out, thereby resulting in a larger drop vs. Bitcoin or Bitcoin futures.